It’s no secret that COVID-19 is impacting PropTech: prior to the pandemic, technology adoption across the real estate industry had been slow, but was making strides when COVID-19 struck. As a result, it’s ironic that something that some predicated would wipe out all of the measured but important progress that had been made over the previous decade ended up pulling unparalleled interest and record-breaking growth forward. In 2020, the paradox surprisingly, and thankfully, created momentum never seen before in the space and carried it throughout 2021. Looking ahead to 2022, we’re seeing continued tailwinds of generational proportions combining with existing momentum driven by COVID-19, and are hopeful that the growth trajectory will continue, and intensify in some areas, as 2022 progresses.

Macro Drivers of PropTech:

A new trillion-dollar infrastructure bill paired with acute housing, climate change, and obsolescence challenges are creating large-scale demand and long-term opportunities for PropTech:

- The Biden Infrastructure Bill is directing hundreds of billions of dollars to the development of new real estate and refurbishment of existing assets. It’s early in the deployment cycle of this capital, but PropTech companies are well positioned to create efficiencies that make this spend more impactful.

- The massive housing shortage: 6.8M units in the US to be exact[1], is putting pressure on construction, affordable housing, real estate prices, and lending products. PropTechs (like Nine Four Portfolio Company Pronto, a leasing and compliance software platform for affordable housing) are well positioned to alleviate some of the pressure by re-imagining paths to home ownership, construction costs and speed, and space optimization.

- Global climate change is forcing investment managers to re-think their strategies and deploy more capital into technologies that support sustainable assets and healthier living.

- The US’s CRE asset base is becoming increasingly obsolete. 60% of US CRE was built prior to 1990[2], which most likely means those assets will require greater capital expenditure and maintenance spend to extend their useful lives or improve their sustainability profiles. Smarter buildings leveraging IoT/sensors, improved maintenance delivery, more advanced building materials and process, and asset repurposing are segments of PropTech that can help solve this problem.

2021 was a banner year for PropTech as a record-breaking number of new companies were founded[3], and category-defining companies began to reach scale. Yet there is still so much room for improvement and so much work to be done. Built world tech adoption is increasing but still significantly lagging other major areas of the economy. For example, the average tech budget for construction stakeholders is 50% less than that of other industries[4]. In addition, the amount of VC interest and dollars flowing into the space is growing, but it’s nowhere near proportional to what the largest markets (e.g. construction, insurance, energy, etc.) in the world should be attracting. This creates an exciting backdrop for PropTech and implies room for growth ahead.

Last year we predicted that the startups best positioned for success were those leveraging higher margin, less capital intense models, and offering cost optimization technologies and/or increasing end user productivity. While we continue to remain focused on those company characteristics, we’ve expanded the verticals we’re focusing on from construction, insurance, and property management, to the “FinTech corner of PropTech”, the monetization of real asset classes, home and commercial services, and ESG. The rate of innovation within these areas is heating up and changing rapidly. While there is a lot of unknown, we feel one thing is for sure: we’re at an inflection point in the biggest digital transformation in the largest asset class in the world, and we expect 2022 will be an even bigger year for PropTech than the year before.

Building off of our PropTech Trends from last year, we hope this discussion provides an illustrative overview of all the exciting technology developments we experienced in 2021 and what we expect to happen in 2022. Hopefully this serves as inspiration for those stakeholders considering adopting new technology and founders thinking of building new category defining companies. If you have any feedback, comments, or questions, please get in touch!

Trend: Construction Finance

Construction finance has been a major focus area for Nine Four Ventures for many years. Early on in Fund I, our LPs at the intersection of banking and construction tipped us off to the historical challenges of sending and receiving payments and managing AR/AP across the landscape. Heeding their advice, we subsequently took a deeper dive into the space, followed the fund flows from lender to vendor and discovered a trillion-dollar, fragmented, and offline market in desperate need of technology innovation. We noticed that many industry stakeholders, particularly smaller contractors, aren’t paid for 30-60-90 days+. This creates a misalignment of incentives and results in slow moving projects. As a result, we’ve been hyper-focused on investing in technologies that are modernizing money movement by condensing those repayment periods and managing cash flow crunches in a secure and compliant way. The goal is to ultimately realign incentives and help complete new projects on time (or faster!) and on budget. This is what led us to invest in Built Technologies, which is digitizing construction loan draw management between “upstream” stakeholders (e.g. banks, developers and GCs), and OpenSpace, which is creating data to support the construction process and keep more accurate tabs on project progress. Siteline is another exciting company building a suite of software products for industry constituents designed to improve the speed and precision in which they can make financial decisions at the center of construction payment flows.

Analogous to the verticalization of digital banks across the consumer landscape, we expect the same specialization to occur in B2B transactions across construction. Digital banks built for specific consumer and borrower personas such as Chime for the underbanked, GreenLight for families, and Current for teens, may provide a glimpse into how built-world personas can be catered to as well. Virtual and physical debit and credit cards for GCs, specialty trades, fleet managers, designers, architects, or suppliers will all most likely benefit from a suite of FinTech products tailored to the nuances of the industry (e.g. lien waivers) and exact needs of their businesses (e.g. AR/AP integrations). As a result, those startups such as Coast, Nuvo and Vergo that address a specific need and offer products tailored to solve specific problems for certain personas may be at an advantage compared to more generic, horizontal solutions.

Many of these FinTech products, especially those facilitating credit, will require infrastructure to automate crucial back-office functions such as AML/KYC, capital markets and servicing, among many others, in a scalable way. For example, the majority of FinTechs that offer credit products require debt facilities. The relationship between FinTechs and lenders, starting with the application process all the way through to the financial reporting and monitoring phase, requires a lot of heavy lifting (e.g. communication and information) from both sides. The ability to structure and present clean data and standardize and automate back-office workflows so that FinTechs can focus on more mission critical work, get up and running faster, and operate more capital efficiently is game changing. This is what led us to invest in Finley, which is building a debt capital management software platform that automates the back-end capital markets function for FinTechs.

The size and global scale of this market combined with the number of stakeholders, segments, and asset types that touch it create a myriad of opportunities transcending the construction development lifecycle. Whether you’re a front-end platform or back-end infrastructure application, we’d love to hear from you, learn more about your business and plug you into our network!

Trend: Supply Chain Procurement

As consumers, we’ve all experienced the strain COVID-19 has put on the global supply chain in one way or another. Materials were already expensive prior to the pandemic, but COVID-19 only made things worse by pushing prices higher and making turnaround times longer. This has put new stress on all stakeholders that touch the construction development lifecycle, but few, if any, are feeling the logistical nightmare more than trade contractors. Previously, trade contractors could often rely on a single supplier for the materials they needed to complete a job they were hired to do. Due to inventory shortages across the board, contractors today might have to rely on multiple suppliers which requires them to “split” orders across distributors, only adding logistical complexity to an already opaque workflow. Even if a supplier does have the inventory needed to fill an order, the price is often much more expensive. This is what led us to invest in Agora, a construction materials procurement startup that allows contractors to streamline their procurement processes and manage orders from multiple suppliers in real-time.

Agora is just scratching the surface of all the possibilities in this space. There are lots of other opportunities for technology innovation to positively impact supply chain fulfillment beyond just construction and across industry type (e.g. home services) and raw material type (e.g. steel and lumber). These platforms also serve as amazing opportunities to embed FinTech and InsurTech to increase wallet share and reduce churn which we’ll discuss in the next section. Startups such as Boom & Bucket, a software management platform and marketplace for used construction equipment, Concord Materials, a business management software platform for concrete manufacturers, Felux, a software management platform and marketplace for the steel industry, and Join a pre-construction collaboration software platform are already increasing productivity, decreasing turnaround times and driving costs down for participants across the ecosystem.

Trend: Embedded Products

The emergence and maturation of the construction finance and procurement platforms discussed above are laying the groundwork for robust FinTech and InsurTech product roadmaps that include payments, financing, and insurance. Given that customers already use these existing platforms to run core functions of their businesses, it presents opportunities for these platforms to deliver additional products and services by embedding them into the workflows their customers already use every day. This simultaneously saves time and costs for users and increases wallet share and reduces churn for platform operators. Platforms can embed these new products one of two ways: 1) vertically integrate or 2) outsource to third party vendors such as Unit. There are very real tradeoffs to each path, and it is recommended that a thorough buy vs build analysis is conducted prior to making a final decision. Vertical integration results in higher margin products and better quality control but requires more meaningful upfront time and capital to launch and additional resources for ongoing maintenance. Alternatively, platforms that leverage independent third party vendors can get up and running faster and more cheaply but sacrifice profit margin and quality control. In addition, working with third parties can often lead to disjointed, unpleasant customer experiences that unfortunately result in lower conversion and NPS. The biggest disadvantage of outsourcing to third party vendors is not actually owning the technology IP or the data that goes along with it, which can add considerable amounts of value to a business in more ways than one. As a result, some FinTechs are initially partnering with external vendors to get up and running faster but building the back-end infrastructure over time to bring embedded products in house to benefit from higher margins and valuable IP. Ultimately the calculus that goes into buying vs building greatly depends on each individual companies’ stage, priorities, goals, etc.

Trend: Workforce Management

Human capital is the most important asset of every company, including construction. Yet, most general contractors still manage their workforces in Excel or internally built systems even as workforces become increasingly distributed and remote. This is putting increased pressure on existing monolithic workforce management solutions and custom integrations. As construction firms buy more cloud native applications to help run other functions of their businesses it will become more and more important to integrate with those apps in order to operate and manage workforces more efficiently. This is what led us to invest in Bridgit. Bridgit’s real-time data structuring and standardization of workflows is game changing, and any firm not leveraging its integrated, cloud-native workforce management software platform will be at a disadvantage going forward.

Following our focus on expediting the flow of funds throughout the construction development lifecycle, there could be holes to fill in the way construction employees are compensated and delivered benefits. A financial product suite consisting of time tracking, payroll, benefits, etc could be exciting for new or existing applications to incorporate into their platforms in the future. Layering on those additional products can help expand TAM, increase growth, and improve competitive advantage by contributing to the complexity of a startup’s activity system making it difficult for copycats to follow or new entrants to displace.

Trend: Digitally Native Direct Insurance

Last year we wrote about the emergence of digitally native direct insurance and the customer acquisition and underwriting advantages it benefits from compared to industry incumbents. It makes sense to acquire, renew, and retain policyholders online and leverage technology to underwrite new policyholders to drive down subsequent claims and losses. That’s why it was fascinating to watch how the initial wave of InsurTechs such as Lemonade, Hippo, Root, and Metromile performed in the public markets. Although all debuted with >$1B in market capitalization and some with >$5B (no small feat!), there have been some challenges in recent months. Although these companies were growing quickly, their loss ratios were higher than expected when compared to acceptable industry averages. As a result, the public markets penalized them for that and provided a prescient reminder that not all revenue is created equal and there are unfortunate negative consequences for sacrificing margin and cost structure for revenue growth.

Although they’ve been penalized as of late, the first wave of InsurTechs educated the market and paved an easier path forward for a second wave of InsurTechs. Learning from some of the mistakes the first wave made, the second wave appears to have a refined focus on 1) policyholder quality by narrowing the underwriting goal posts with fronting carriers and 2) CAC by pursuing more cost-efficient growth distribution partnerships. This new approach should help protect the second wave from making some of the same mistakes as the first wave and is why we remain excited about the opportunities for startups to sell insurance directly through digital channels. As a result, we re-invested in Steadily’s Series A and expect to see more digitally native InsurTechs serving specific product lines such as renters (e.g. Goodcover), homeowners, landlord, business, workers comp, etc. across residential and commercial going forward.

One specific area that we believe has currently been overlooked and neglected by technology innovation is construction insurance. Every year premiums go up and the amount of attributable coverage goes down. Through our experiences working with other InsurTechs across other areas of the built world, we’re strong believers that technology can help solve this bifurcation frustrating both policyholders and insurers. As more cloud applications are being used and engaged with more frequently on construction sites, more data is being created and aggregated to potentially be used to assist insurers in making better underwriting decisions. For example, startups such as Shepherd are plugging into existing platforms such as Procore to get visibility into the quality of work being completed and if it’s being completed on time and on budget. Subsequently, correlations can be made between those metrics and outcomes, whereby reducing the latest trend and resulting in reduced claims and losses for insurers and lower premiums for policyholders. This API approach is genius because it doesn’t require policyholders to buy, train, and use a new application tradesmen and women are already reluctant to use. When thinking about all of the types of stakeholders, segments, asset types, and policy types across the construction insurance landscape, the opportunities are massive.

Trend: Insurance Infrastructure and Software

The insurance industry is rapidly evolving. More digitally native direct insurance companies are coming to market and proving they can serve policyholders through digital channels. The velocity of growth for many of these companies is impressive, yet too often these upstarts run into scale limitations due to their inability to efficiently manage mission critical back-end infrastructure such as risk and compliance, claim management and certificate verification. Until recently, digitally native direct InsurTechs had to build infrastructure internally, which made it hard to keep up. This started a vicious cycle: more growth leads to more claims and requires broader oversight, which created a challenge of needing to scale front-end products simultaneously with back-office functions. Building the infrastructure to automate the back-office functions is hard and takes valuable time, engineering, and capital resources away from the rest of the business. Fortunately, InsurTech infrastructure startups have taken notice and have built integrated technologies that alleviate a lot of the friction associated with scaling backend infrastructure. As a result, many digitally native direct InsurTechs can now focus on their front-end products while outsourcing mission critical back-end infrastructure development and maintenance to third party vendors. This is what led to our investments in Handdii, which is automating small claims management for insurers, TrustLayer, which is automating certificate verification and monitoring, and AgentSync, which is building compliance management software for insurance agents.

Digitally native InsurTechs aren’t the only stakeholders running into scale limitations. Incumbent insurers and institutional building owners, operators, and managers, among others, are too! Although those players already tend to be quite technical and sophisticated, a majority still rely on offline processes. As a result, they could benefit from the standardization of workflows and subsequent structuring and cleaning of data sets to more intelligently and cost efficiently protect assets against risks. For example, Archipelago, a risk mitigation platform, helps institutional owners manage potential threats against their portfolios by offering an end-to-end solution that connects asset-level data from all documents, sources and systems across the portfolio lifecycle. This newfound visibility leads to more comprehensive coverage, less exposure, better placements, lower prices, higher NOI and more valuable real estate assets. Further, the resulting improvement in risk controls could potentially allow owner customers to deploy capital faster in an increasingly competitive market.

Trend: SFR Infrastructure

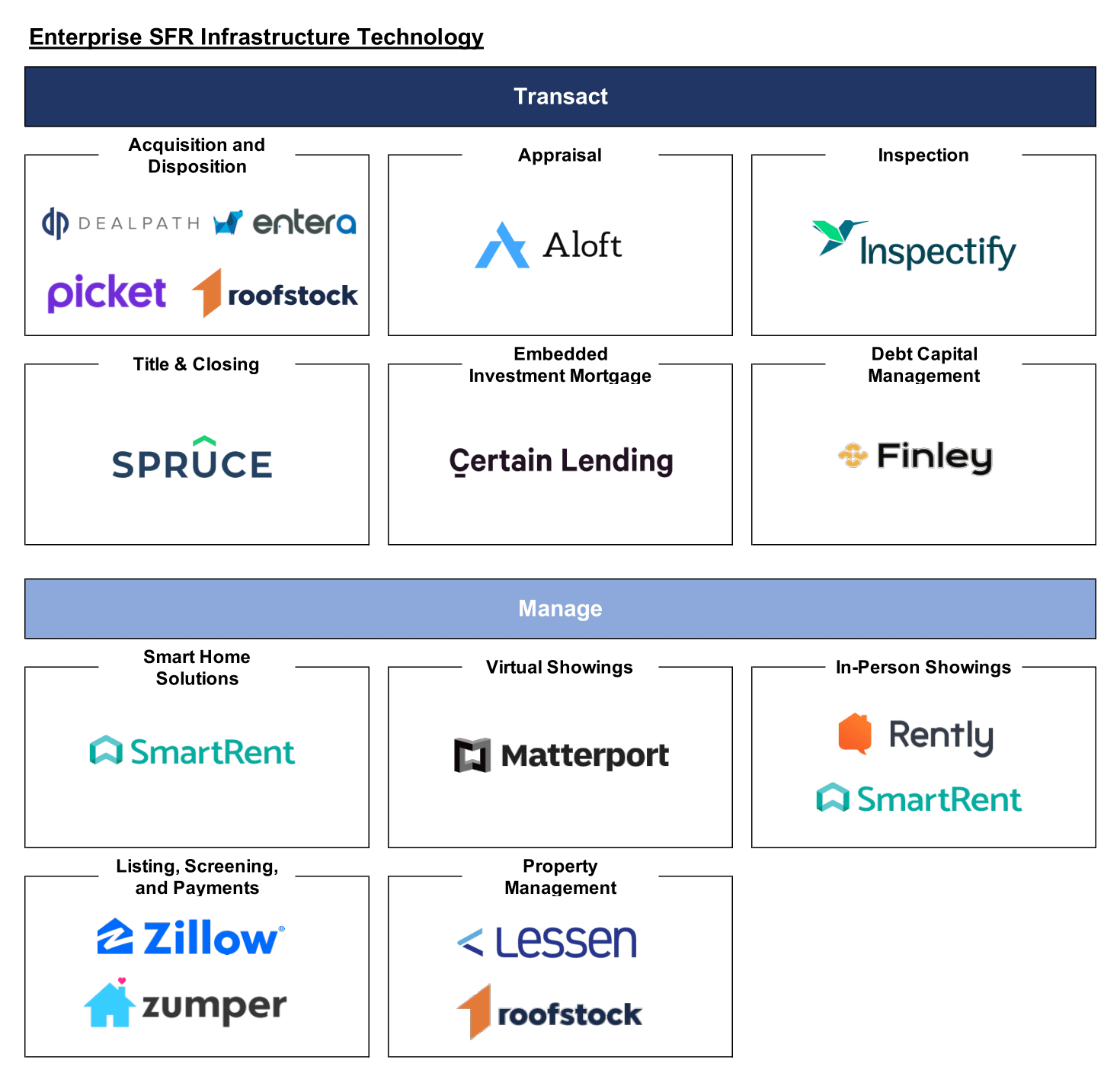

The value of the US single family home market is $30T+ making it one of the largest and most valuable real estate markets in the world[5]. That, combined with consistent positive performance with lower volatility over the decades, has drawn the attention of institutional investors looking for an attractive risk adjusted return on investment. As a result, over the last decade we witnessed the early institutionalization of single-family rentals (aka “SFRs”). Invitation Homes pioneered this approach coming out of the depths of the Great Recession and others slowly followed in their footsteps until a massive wave of tens of billions[6] of dollars flowed into the space over the last 18 months looking for higher returns compared to the bond market and a hedge against rising inflation, among other things. All of this new capital has put a strain on existing SFR lifecycle segments across search/discovery, to inspection, appraisal, acquisition, construction (ground up or renovation/remodel), and lending. As a result, investors are looking for technologies to help deploy capital faster without sacrificing compliance and manage growing scattered site portfolios more efficiently at scale. This has created major opportunities for PropTech startups Nine Four Ventures has already invested in or is watching closely.

Two fast growing startups reducing the amount of friction involved with capital deployment are Entera and Picket Homes. Both provide software platforms that assist institutional buyers with the search and discovery of new assets and help streamline the acquisition of new homes. Nine Four portfolio company Inspectify is a home inspection software platform and marketplace that allows institutional buyers to book and coordinate home inspections, purchase insurance and warranties, fulfill work orders, and serve as an ‘operating manual’ for the home. This allows institutions to correlate outcomes to specific home characteristics and reduces the amount of time needed to renovate a home between purchasing and leasing. Certain Lending is a mortgage fulfillment platform that underwrites buyers faster (in minutes versus days) and at more attractive terms compared to existing options. This allows investors to deploy more capital faster and more cheaply which are unfair advantages in a highly competitive market. Aloft is a residential appraisal platform streamlining the appraisal process for appraisers and lenders. By automating back-end work for appraisers, it saves lenders and subsequently investors valuable time by providing accurate reports back in days versus weeks ultimately allowing them to win new deals with speed previously not thought possible.

Although investor interest in the space has been growing quickly, institutional ownership still only represents 1-2% ownership of the US single family rental market which constitutes 16M of the 80M+ single family homes in the country[7][8]. This implies a lot of room for growth for SFR investors and a ton potential for startups to support them on their growth trajectories.

Trend: Op Co and Prop Co Evolution

In the Summer of 2019, we wrote about the increasing number of OpCo/PropCo offerings coming to market. Startups and tech-enabled operators pitching their ability to operate real assets at scale were hunting for pools of real estate capital, and investors started listening. The relationship is symbiotic: PropCo investors buy the real estate, OpCos run it efficiently and at scale. Everyone wins: OpCos scale faster and no longer need to find creative ways to access real estate on an asset-by-asset basis, and PropCo investors can deploy their capital in meaningful ways with an operator they’re comfortable with. PropCos no longer need to fight the same asset-by-asset battles to fill it with tenants that can pay them the right amount, and the one-to-many underwriting advantage can be taken advantage of.

Since then, the world has changed for real estate owners and operators. COVID happened, a new administration took office, inflation started creeping up, global supply chain issues continued, and a trillion dollar plus infrastructure bill was presented, just to name a few. These dynamics appear to be building even more momentum for the OpCo/PropCo, although where we were seeing more demand from OpCos to find PropCo investors, the tables appear to have turned: it’s the PropCo investors hunting for the right OpCos to work with. This could be happening for two reasons: 1) PropCo investors are looking for better relative investment performance of an asset versus the way it may be traditionally monetized and 2) as more money floods into the space, PropCo investors need to deploy meaningful amounts of capital in an efficient way.

The Mynd/Invesco and Bungalow/Deer Park Road deals are important to highlight. Mynd features the demonstrable progress that the traditionally low margin and painful business of property management is making. No traditional operator at scale is likely capable of doing this, so Mynd is in a pole position to see if the way they manage properties really can scale. If that’s the case, it will be very lucrative for them. Nine Four portfolio company Bungalow operates single family homes in a differentiated way relative to traditional owners. While the asset is the same (a single-family home), the hypothesis is that the way the asset can be monetized, in this case through a co-living model, implies different cash flows, operational complexities, and profit. The ability to operate at scale, and with greater NOI, could be even more lucrative than for traditional managers or operators.

If real estate is going to be seen as an inflation hedge, which appears to be the case right now, then there will be more dollars flowing into the space and more pressure to deploy that capital across real assets. That would result in an increased opportunity for tech-enabled operators of real estate to prove their ability to scale. We’re biased here, but we believe that technology will have the opportunity to shine and prove that it can, in fact, drive meaningful change in a historically slow moving and lower margin industry.

Thank You and Please Reach Out!

Thank you to Nine Four Ventures’ MBA Associate Interns Sam Mulholland and Caroline Giroux for completing a meaningful portion of the research in and making significant contributions to this post. If you’re an industry stakeholder considering adopting new technologies and strategies or a founder building a new category defining company, please reach out. We would love to speak with you!

[1] US Bureau of Labor Statistics, October 2021

[2] U.S. Energy Information Administration CBECS, September 2021

[3] Pitchbook Data

[4] Procore S-1/A, May 2021

[6] Globe St.com, October 2021