The US construction industry is massive and growing – currently accounting for $11T annually[1] and expected to grow to $15.5T annually by 2030[2]. Despite construction playing a significant role in our economy and infrastructure, it’s still plagued by high costs, low productivity, and misaligned incentives, especially when it comes to payments and flow of funds. A new wave of construction tech companies has begun to emerge with the intent of solving these problems.

Overview of the Construction Lifecycle and Key Themes[3]

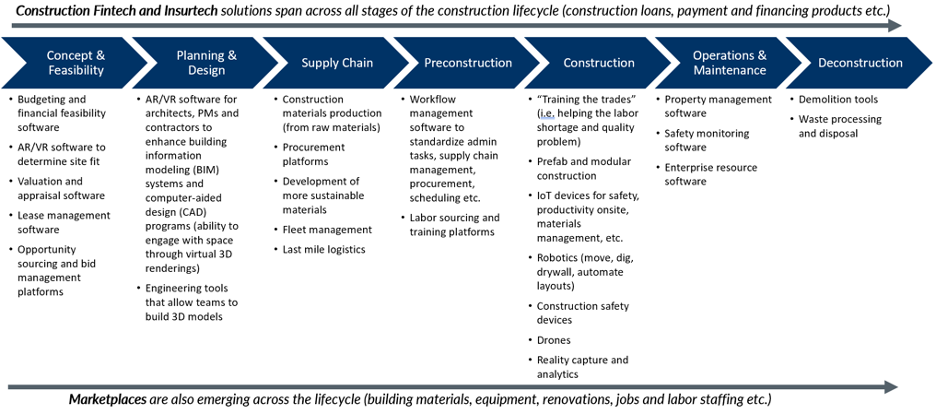

Nine Four Ventures defines construction tech, ‘ConTech’, as technologies that impact the people, processes and ecosystems that interact with construction sites across the real estate asset lifecycle. Entrepreneurs are delivering new construction technologies through a variety of models including SaaS, hardware, Fintech, and various marketplaces.

Nine Four has focused on identifying and investing in businesses across the construction lifecycle including workforce management software (Bridgit), computer vision software (OpenSpace), FinTech and InsurTech (Built and Handii) and materials/equipment (Agora). One commonality across these businesses is that they are all software platforms designed to move construction processes away from Excel, pen/paper and custom integrations. Customers now expect cloud-native software solutions that integrate easily with other applications or legacy systems. These characteristics position new startups well for broader market adoption and faster subsequent growth.

Early Progress in ConTech

The construction industry’s investment in technology has been off to a slower start than some other verticals within the PropTech space. Traditionally, construction processes have been managed offline or in Excel, which creates long turnaround times and more room for human error. Many legacy systems still in use, such as Autodesk, Trimble and Textura, were developed 20+ years ago and cannot always integrate with new technology to seamlessly meet business needs. That said, we have witnessed the beginning of a major digital transformation over the last few years through an initial transition from offline to online. SaaS solutions, like Procore[4], that allow companies to manage all phases and aspects of projects, from pre-development to completion have brought increased efficiency and automation to construction. Plangrid[5], which provides businesses with real-time updates and seamless file synchronization, and Levelset[6], which is focused on a creating a cloud-based payment process, have also been impactful in moving construction into the digital age.

Additionally, we are seeing new technologies emerge in areas such as photogrammetry (OpenSpace), building information modeling software (SketchUp by Trimble), robotics (Built Robotics), 3D printing (Mighty Buildings) and modular construction (Juno) that are disrupting and improving the industry. As data becomes increasingly important in decision making, developers are focused on software solutions that will help construction businesses capture, normalize, and leverage their data more efficiently. Many of these technologies and businesses have begun to attract venture capital attention with over $3.2B[7] raised in the construction tech space in 2021.

Materials Fulfillment

The construction industry has been hit hard by current global supply chain issues, spurred by Covid-19. Due to port congestion in Asia, labor shortages in the U.S. and global semiconductor shortages, construction materials have been in short supply and more difficult to secure – not to mention, prices have increased substantially. Within the supply chain and fulfillment space, we are particularly interested in materials management software and procurement platforms that will help to streamline the procurement process and ease the burden currently placed on contractors and subcontractors.

Agora is focused on building a materials management platform that streamlines the materials supply chain for commercial trade contractors by connecting field foremen, purchasing teams, and vendors on one platform. Material Bank, Fohlio, Source and StructShare are also focused on streamlining and digitizing the material management space. The rise of blockchain technology could also eventually play a role in relieving some pressure on supply chain infrastructure by facilitating smart contracts and eliminating high transaction costs.

Looking Forward

Several macro trends including the Covid-19 pandemic and the recent Biden Infrastructure Bill have further propelled the ConTech transformation. An influx of new capital into construction, development and sustainable energy provides a timely tailwind for startup entrepreneurs and emerging businesses. Building operations and construction are responsible for 37% of global carbon emissions[8] and will require global attention and significant investment to reduce impact on climate change over time.

Additionally, we’re dealing with an aging workforce where the average age of a construction worker in the US is 42.9[9]. The workforce may likely continue to age as millennials and Gen Z’ers opt for roles that are less dangerous and not as physically demanding. Construction work requires performing difficult manual labor, often in the rain or cold, and risking potential injury or worse on a regular basis. Why would someone become a construction worker when they could work in a fulfillment center for higher wages? Manual processes and the aging workforce combined with the current supply chain issues and shortages in raw materials, have made tech innovation in the space more important than ever.

There is an enormous amount of white space right now and few winners have emerged thus far, which equates to a huge opportunity. We’re excited to be a part of the ConTech transformation and see what entrepreneurs will build next!

By: Caroline Giroux (MBA Associate Intern)

[1] McKinsey Global Institute: Reinventing Construction

[2] Global Construction 2030: A Global Forecast for the Construction Industry 20 2030 (PwC)

[3] Graphic by Nine Four Ventures,

[4] Procore IPO in 2021

[5] PlanGrid acquired by Autodesk in 2018

[6] Levelset acquired by Procore in 2021

[7] PitchBook: 2021 Vertical Snapshot – Real Estate Tech – Construction

[8] IEA 2021a. All rights reserved. Adapted from “Tracking Clean Energy Progress”

[9] Bureau of Labor Statistics: Labor Force Statistics from the Current Population Survey