As we’re all well aware, COVID-19 took the world by storm in 2020. It acted as a major change agent across every inch of every industry around the world. For better or worse, it significantly impacted the way humans work, live, and play, and as a result, fundamentally changed the way people, processes, and ecosystems interact with the built world. Prior to shelter-in-place, and over the previous decade, the built world was already experiencing a foundational transformational shift from offline to online. However, as COVID-19 was unfolding, and even in light of the existing technological shift, there was genuine concern that the progress that had been built over so many years would come to a grinding halt.

Fast forward to 2021 and COVID-19’s impact on PropTech was greatly dependent on business model and asset class. It’s no secret that some sectors, such as commercial office, hospitality, restaurants, retail, etc., and models, such as master lease and tech-enabled non-SaaS, were and continue to be harder hit by higher vacancy, early terminations, and lower gross rent rolls. Those challenges have created a difficult environment for the PropTech startups selling to and through CRE owners who subsequently now have a lower willingness to pay and a higher requirement for immediate ROI.

Comparatively, startups leveraging SaaS and SaaS-like models across construction, asset management, banking and insurance inflected during 2020. Surprisingly, transaction volumes rebounded quickly and financing markets remained open, bolstering the original tailwinds that were driving PropTech adoption pre COVID-19. Even more extraordinary has been the astounding velocity in which new cloud technologies have been adopted and integrated into status quo workflows and paradigms during the pandemic. The rapid acceleration of cloud native technology adoption is a testament to just how critical, resilient and deeply engrained the tech backbone has become within the broader real estate industry. As markets “re-open” and incumbents’ willingness to pay increases, it bodes well for those PropTech companies filling mission critical voids.

As a result, Nine Four Ventures believes the startups best positioned to succeed will be those that are leveraging higher margin, lower capital intense models, selling to and through less impacted stakeholders and offering cost optimization technologies and/or increasing end user productivity. Saving customers money has been a critical selling point and contributing to the incredible appetite for cloud native technology. As a result, companies are growing faster and being valued higher than ever before. According to the Bessemer Cloud Index, median EV/ARR revenue multiples for publicly traded SaaS businesses are at or just below all-time highs around ~18x. How long this period of growth will continue is anyone’s guess, and what goes up can certainly come down, but the longer this period lasts the more permanent user behaviors, buyer decisions and durable markets become. The most important thing in this environment is to stay vigilant for sustainable product market fit rather than technologies with COVID-19 market fit that could easily be a flash in the pan.

Building off of our PropTech Trends from last year, we hope this discussion provides an illustrative overview of all the exciting technology developments we experienced in 2020 and what we expect to happen in 2021. Hopefully this serves as inspiration for those owners considering adopting new technology and founders thinking of building new category defining technologies. If you have any feedback or questions, please get in touch!

Trend: Construction FinTech

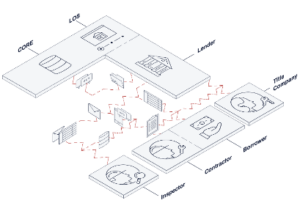

We’ve written about it here, here and here, but construction fintech continues to be a major PropTech focus area for us because it is attempting to tackle enormous pain points in a massive, complex global market. Every year trillions of dollars of funds flow through the construction ecosystem to pay myriad stakeholders including lenders, developers, general contractors, sub-contractors and suppliers, involved in many different types of projects across asset classes. Traditionally, the industry has operated offline in pen, paper, and Excel, creating status quo inefficiencies and leading to long turnaround times, errors, and a lack of transparency.

Construction loans are considered much riskier than a mortgage and is why they’re given in disbursements, otherwise known as “draws”. Draws are approved when certain project milestones have been completed so that lenders have a better sense of their collateral in the event of a default. Lenders hire third party inspectors to inspect a project site in person to determine how far along a project is, if it’s on budget, time, etc. Those inspectors typically go on site with a physical piece of paper and a check list to document project progress. That piece of paper is mailed to the back office of a lender who updates an Excel model and disperses the appropriate amount of funds to the developer of the project. That developer then pays their general contractor, so that they can pay their sub-contractors.

Source: Built Technologies

This slow, offline paradigm has created generally accepted slow turnaround times and 60-90-120 day repayment periods. Herein lies the problem. Contractors often have to buy the materials they need to build or renovate an asset they were hired to complete. However, they don’t get paid back for 60-90-120 days, so often times contractors are left using their own cash or expensive credit to purchase the materials they need.

By digitizing inspections and facilitating payments faster to appropriate stakeholders it aligns incentives! Leveraging software, lenders can complete more draws without sacrificing compliance, contractors can get paid faster to reduce their cost of capital and developers can finish projects faster improving their IRR. As a result, there is an opportunity to build multiple category defining companies solving current complexities and misaligned incentives.

This is what led Nine Four Ventures to invest in Built Technologies, which is building the vertical payment chain for construction and OpenSpace, which is digitizing construction inspections to allow inspectors to remotely calculate the amount of work completed. There are many more opportunities for additional FinTech companies to build category defining construction finance businesses including a) integrated hardware/software (Brex for construction), b) Venmo-like payment apps (Built Technologies, Flexbase, Levelset, Punchlist, & Siteline), c) lending (Billd and Renofi), d) order management systems (Agora), and e) photogrammetry (Avvir). Northspyre is another exciting company building software for developers to digitize operations and improve the speed and precision in which they can make better data-driven decisions around contingency planning at the center of construction payment flows.

Trend: Digitally Native InsurTech

For centuries, agent networks played a critical role in the current insurance landscape by helping carriers a) acquire new customers, b) service claims and c) renew policyholders. As the number of policyholders has increased, incumbents have hired more agents rather than leverage technology to scale with and service growing volumes. Although agent centric workflows have worked until now, they weren’t designed for a digital first world and have had an adverse impact on margin expansion, policy pricing and service quality. With the advent of the internet, the secular shift from Baby Boomer to Millennial asset ownership and COVID-19 driving rapid digital adoption, agents may no longer be the most efficient channel to acquire, service and renew policyholders. Industry outsiders have recognized this opportunity and have applied new perspective and technology to the age-old agency model and are starting to turn it on its head.

GEICO was one of the first to successfully utilize the direct model to circumvent agent networks and sell directly to potential policyholders online. Subsequently, newer InsurTechs such as Next Insurance for SMB insurance, Root Insurance for auto insurance, Lemonade for renters insurance and Hippo for homeowners insurance have all recognized the benefits of the direct model. What theoretically makes the online direct model advantageous is its lower cost structure compared to traditional carriers. By supplementing agent networks with technology, and playing into Nine Four Ventures cost optimization theme for 2021, InsurTechs are able to reduce overhead costs and re-allocate savings to R&D to improve product, S&M to grow faster and even policyholders in the form of lower premiums.

Selling direct has its advantages but it’s important to keep in mind that by removing agents, InsurTechs potentially expose themselves to unique risks and costs which have to be taken into consideration. First, agent networks are typically used as a first line of defense in identifying and preventing fraud and high-risk underwriting. Second, it’s difficult to replace the trusted, inter-personal relationships built over time between agents and policyholders. Although technology can help predict and identify bad prospect and/or policyholder behavior and streamline the claims process, there is no fully digital alternative that’s more effective than human-in-the-loop, atleast not yet. This is why many digitally native, direct insurance companies are not completely abandoning agents and instead opting to leverage omni-channel, hybrid approaches to start. This way, InsurTechs can acquire, service and renew policyholders either digitally or offline – whichever channel the prospect or policyholder feels more comfortable with, whereby optimizing for cost structure and without sacrificing risk and long-term policyholder relationships.

This is why Nine Four Ventures invested in Steadily, a digitally native, direct landlord insurance company. With the recent success of Lemonade in the public markets and Hippo and Next Insurance in the private market, it makes customers and investors hopeful that new innovative InsurTechs have staying power in the marketplace. While the jury is still out on whether the underlying fundamentals actually support the valuations of those InsurTechs, there’s general consensus that if executed appropriately, there are many long-term strategic benefits to operating digitally. So it will be exciting to watch how this space evolves and to help build category defining digitally native, direct InsurTechs around individual product lines such as renters (Goodcover), homeowners (Hippo), landlord (Steadily), workers comp (Pie Insurance and Foresight) and builders risk!

Focus Area: B2B Insurance SaaS

Nine Four Ventures is interested in companies delivering insurance product lines through new digital channels and streamlining offline, decades old workflows. The needs of policyholders are dramatically changing, and as other parts of consumers’ lives are digitized, they expect the same experience from insurance providers. As a result, this recent behavior shift has placed new pressure on incumbents to execute faster and more digitally without compromising security and compliance. This has created opportunities for startups to automate manual backend infrastructure processes that allow insurance incumbents to focus on their core, policyholder facing products.

The first critical area of insurance that has been traditionally neglected by technology is property claims estimation. Historically, when a policyholder filed a claim, the insurance carrier assigned a human adjuster to physically inspect the damaged asset in person. This slows down claim turnaround time and adds extra cost to the process. As a result, new startups are building photogrammetry technology that automatically build 3D models of damaged assets, from a few photos, and can accurately identify the type, amount and cost of materials damaged. This is a leading edge technology that falls directly into the cross hairs of Nine Four Ventures cost optimization theme of 2021. For the first time, and especially during COVID-19, human adjusters can work from the safety of their own home and complete adjustments remotely using the photogrammetry technology being built by startups such as Flyreel, HostaLabs, and PLNAR.

The second area that has been traditionally neglected by technology is property claims management. Today, resolving small claims is slow, expensive, and offline, often times resulting in low policyholder satisfaction and minimal cost visibility or transparency. It involves managing many stakeholders and is dependent on myriad steps. For example, carriers have to log, inspect, estimate, and pay claims, manage contractors and communicate with policyholders. It’s challenging to say the least! As a result, startups such as Handdii are building “connective tissue” software platforms to manage small claims for insurers and streamline claims from initiation through contractor selection and work completion. This drives increased productivity for insurers, higher conversion leads for contractors and improved policyholder satisfaction.

An advantage of digitizing claims estimation and management is the structuring of data. Through online workflows, more and potentially new data clusters can be collected, labeled, QA’d and trained to reduce risk. 2020 was a rough year for insurance outcomes (hurricanes, wildfires, COVID-19, etc.) that will have a direct impact on rising premiums in 2021 and beyond. As a result, there is appetite to explore new technologies being built by Arturo AI, Cape Analytics and Kettle that can drive improved risk models to reduce claims and subsequent losses.

Trend: Mortgage Servicing

Over the last half century or so, and as the US housing stock and subsequent mortgage volume increased, lenders needed a way to service loans. As a result, lenders and third-party servicers traditionally hired more people rather than leverage technology to service those volumes. To a certain extent, people-intensive workflows can work, and it has until now, but, at a certain point, overhead has an adverse impact on margin expansion, end-pricing and service quality.

Over the last year or so, technical founders have discovered the challenges associated with this market and started building relevant optimization technology. We’ve seen new mortgage servicing startups such as BraceAI, Haven Servicing, Peach Finance, and Valon Mortgage take one of two approaches: 1) selling SaaS to existing incumbents or 2) building proprietary technology and becoming a tech-enabled, vertically integrated mortgage servicer. Upon initial review, selling SaaS might seem like the most advantageous approach seeing as though valuation multiples of publicly traded SaaS companies are hitting all-time highs largely driven by the recent “Great Acceleration” of software adoption brought about by the advent of COVID-19. However, selling SaaS in this particular part of the built world ecosystem may have its drawbacks. For example, traditional mortgage servicers tend to be tech adoption laggards, which makes it difficult to sell to them and to convince end users to actually use the product. In addition, traditional mortgage servicing is a low margin business so adding extra layers of costs on top may not jive with current incentives. If software is purchased it may actually force the mortgage servicer to increase their end customer prices which may put new stress on customer relationships and inadvertently force customers to take their business elsewhere.

To bring about much needed breakthrough change, new mortgage servicing technology may require a completely new perspective. As a result, vertical integration might be the most advantageous go-to-market strategy. Tech-enabled vertical integration is not new to the built world. Tech-enabled brokerages led the charge. Nine Four Ventures’ portfolio company Bowery Valuation followed in commercial appraisal. The idea is to develop proprietary software and keep it “in house” whereby only allowing W2 agents or appraisers or servicers to use it. Utilizing a vertically integrated approach, an expert human remains in-the-loop. The technology is not meant to fully replace humans but rather make them more productive and more efficient, expanding gross margins and allowing for cheaper price points with more reliable and less error prone, high quality service. The digitally native products and deliverables are also orders of magnitude better. Rather than scans and PDFs and disjointed data, customers can click through cloud-based reports and transactions, and have full transparency into processes.

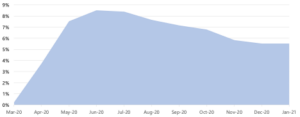

As a result, it’s difficult to know which approach will win in the end but it will certainly be exciting to watch how this space evolves. One unfortunate trend working in mortgage servicing technology’s favor is the dramatic increase in mortgage forbearances since the onset of COVID-19. According to the Mortgage Bankers Association, >8% of all mortgages in the US entered forbearance in April 2020 up from <1% in March 2020. While the number has decreased, it has plateaued around 5% entering 2021 which may be the forcing function needed to push lenders and servicers over the technology “hump”.

Share of mortgages in forbearance, weekly:

Source: Mortgage Bankers Association

Trend: Digitally Native Banking & Infrastructure

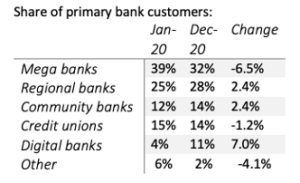

The way consumers bank today is changing dramatically. Consumers are tired of high and hidden fees, bad service, a lack of up-to-date interfaces, security breaches, etc. from incumbents which has eroded trust and confidence in larger institutions. The needs of consumers have been increasingly digital and flexible, but incumbents haven’t been able to keep up. As a result, and although we were experiencing a transformational shift from offline to online banking over the last decade, COVID-19 accelerated the rate of change.

The void left by incumbents has enabled startups to fill the gap. Thanks to products such as Venmo from PayPal and CashApp from Square and neobanks such as Chime, consumers haven’t missed a beat. Users can still deposit, withdraw and transfer money, link credit and debit cards to accounts, pay others and get paid (early!), among many other things, all digitally and reliably from the comfort of their smartphone. Although market uptake has accelerated and is reflected in the run up in valuations of public and private financial services companies, only 11% of users consider an online bank to be their primary account which shows a lot of room for future growth.

Source: Forbes

We’re PropTech investors so what does this have to do with the built world? Although it’s early days, the rapid adoption of online financial services has proven that consumer needs can be met digitally, often times even more efficiently than offline. Given SMBs share some of the same needs and characteristics of consumers, it’s possible to draw parallels between the two and extrapolate the opportunity for PropTech startups to digitize specific financial services and meet the unique needs of a wide range of real estate stakeholders such as but certainly not limited to, property owners and managers, contractors and specialty technicians (electricians, roofers, plumbers, etc.).

These stakeholders have traditionally managed cash flow from myriad receivables (rental payments, invoices, etc.) and payables (e.g.. purchase orders, salaries, etc.) through a hodgepodge mixture of incumbent banks, offline pen, paper and Excel and/or disconnected software. As a result, digitally native financial services can provide a more tailored, central source of truth that not only improves business banking but also helps prepare taxes, builds credit and offers access to cheaper and more flexible capital options (a la Square Capital) more aligned with real estate customer goals and incentives.

Similar to digitally native and direct InsurTechs, it will be difficult to fully replace humans and is why it is likely digitally native banks will leverage omni-channel, hybrid approaches, at least to start. This way, neobanks can acquire and service customers either digitally or offline – whichever channel the customer feels more comfortable with, whereby optimizing for cost structure and without sacrificing risk and long-term relationship building. At the end of the day, every customer wants to know that they will be taken care of and the human-to-human element still plays a big part in that.

The opportunity in digital banking extends beyond user experience and into infrastructure. One of the reasons why incumbent banks have failed to innovate, or at least at the same rate as startups, is because the legacy technology stack of the existing banking system. The amount of infrastructure and information needed to facilitate a single transaction let alone trillions of dollars of fund flows between stakeholders requires myriad integrations with disparate systems. More specifically, every banking related action involves asset verifications, compliance assessments and workflow decisioning for closings, transfers and distributions, etc. To make things even more complex, each one of those actions requires multiple sub-actions. For example, asset verifications require access to asset, employment, payroll, credit and identity data among others. The data exists but often times in siloed environments that do not easily communicate with each other. As a result, the amount of technical debt needed to facilitate banking related transactions has built up over the years and in order to help solve this timely problem, the banking sector has seen a dramatic increase in demand for infrastructure APIs.

APIs are application programmable interfaces that enable seamless interactions between different applications. APIs define the kinds of calls and requests that can be made, how to make them, the data formats that can be used and so on. They are important because they allow developers to focus on building core products instead of commoditized backend infrastructure (payments, messaging, etc.) by abstracting away complexities through a few lines of code and ultimately saving valuable resources such as time and capital. Stripe (for payments) and Twilio (for messaging) are great examples of API businesses that successfully offload painful integrations into single APIs and enable delightful end user experiences.

New banking infrastructure APIs solve problems for both incumbents and new entrants because neither incumbent banks’ nor neobanks’ core competency is infrastructure software development. Thus, infrastructure APIs will enable stakeholders to meet the digital demands of new customer behaviors faster. For example, delivering a seamless, fast and secure experience resulting in higher engagement, increased lifetime value and lower churn.

Startups such as Plaid, Pinwheel, Argyle, Staircase, Sentilink, Synctera and Zibo, among many others, have taken notice. While all are taking distinct approaches and tackling different parts of the financial services value chain, they all have the same goal in mind: democratizing access to financial data quickly and securely. Although we’ve made a lot of progress, we have a long way to go so it will be exciting to watch how this space evolves.

Trend: Exposure of Master Leases

Throughout history, humans have steadily migrated towards and settled in urban areas for a variety of reasons: access to trade, the arts, etc. However, over the last fifty years or so and as the world became more and more industrialized, the mass migration to cities was largely accelerated by people in search of new increased education and work opportunities. As a result, and prior to the pandemic, more people were moving to dense, metropolitan areas faster and with less savings than ever before. As inflation grew and salaries didn’t keep up with costs, it created a bifurcation between income and rents which became more pronounced over the last few years. Something had to give. Co-living’s high-density footprint akin to student housing offered an attractive affordable housing alternative that was missing in many urban cities. Although it’s a nice option for renters, the higher density, smaller footprint can be logistically challenging to operate. The market demand for a cheaper alternative combined with the need for a technology driven operator created business opportunities for co-living startups, such as Bungalow. Those startups subsequently grew quickly and benefitted from the tailwinds generated by the mass migration to cities at the end of the 2010s.

Fast forward to the end of 2020 and COVID-19 practically erased seemingly overnight the urban migration that was happening over the last few millennia! Rather than a mass migration, there has been an exodus. The combination of a decline in demand with an increase in supply made the situation worse and quickly shifted the market from an owner’s market to a renter’s market in many highly populated cities.

Rent Growth by City

Source: Zumper National Rent Report – February 2021

This resulted in meaningful dislocation, leading to increased early lease terminations and vacancy and decreased gross rents by more than 20% in some urban markets. Renters no longer wanted to pay a premium when they couldn’t take advantage of all the things city life typically had to offer. This trend negatively impacted owners and poked holes in the business models of some of the fastest growing master lease co-living and co-working companies.

During the pandemic, and similar to the dot com crash in 1999 and mortgage crisis in 2008, gross rents declined, but much more significantly and quickly. Cloud native technology wasn’t available back in those days so residents had to remain close to work in order to keep their jobs. That buoyed rent prices to a certain extent. Today, with the ability to work from anywhere, employees have the option to move away from cities while simultaneously reducing their cost of living and increasing quality of life. The dramatic pull back in rent prices uncovered serious “overhang” risk with the master lease model. For example, using a master lease, operators lock in base rents to landlords, while the operator subleases to renters. Using arbitrage by increasing density and improving operational efficiency, operators create rent “lift” which is the difference between what they receive from sub leasers and what they pay to landlords (ie sublease rent – master lease rent = gross profit). The drop in demand created a chain reaction: lower demand led to increased vacancy, which drove lower rents, and led to smaller “lift”.

Co-living operators weren’t the only stakeholders feeling the pinch. Short term stay and co-working operators felt it too. Prior to the pandemic, many startups benchmarked downturn overhang risk to what had been experienced during the previous two recessions. Very few people could have predicted a pullback of this magnitude but it’s a good reminder that the only thing that’s constant is change. History may not repeat itself, but it certainly rhymes.

As a result, and to protect against overhang risk in the future, startups leveraging the master lease model will most likely shift to a rev/share model which is an agreement that shares rent upside between landlords and operators at a predetermined rate and does not “lock in” operators to a minimum amount of rent to landlords. Although it’s better for operators it might not be as attractive for landlords resulting in a potential smaller target market. That said, we do expect operators to selectively continue leveraging the master lease model with some of their best performing assets but not across the entire asset portfolio.

A vaccine with high efficacy and a speedy rollout could change all this making it moot. However, it’s unlikely we’ll see the master lease model being used in its current form in the future.

Trend: Uncertainty in the Office

COVID-19 has had an adverse impact on near term demand for CRE office space around the world. As we entered into lockdowns in early March and started the biggest work from home experiment in history, few people probably could have predicted how successful it would be. There are certainly exceptions, but surprisingly, employees have been just as, if not more, productive working remotely (and companies like Nine Four portfolio company Branch Furniture have been helping to make that possible). As a result, there is a debate around what the long-term impact work-from-home will have on the demand for CRE office space.

Now that the work-from-home experiment has proven to be successful, we may not return to a mandatory five-day work week from the office. That implies that the real estate footprints of employers will change. How much is still to be determined, but if the number of employees that will be working from the office is less than it was prior to the pandemic, the amount of sufficient office space needed will be less than before. This is significant because other than headcount, real estate typically accounts for the second biggest cost driver on every P&L so if employers can be just as efficient with less real estate while saving money, that seems like a win-win. But not so fast! Just because the number of employees using a particular space decreases it doesn’t mean an employer can downsize its footprint so easily. In response to COVID-19, employers might have to increase the amount of square feet per employee whereby offsetting the cost reductions realized from lower usage. While we think it’s unlikely the offset will be one-for-one, it’s an extra variable that needs to be considered.

We also expect an increase in demand for shorter, more flexible office leases. In the short term while there are still a lot of unknowns, tenants will likely prioritize those which will not make things any easier on asset owners. However, as things start to become clearer with the advent of a vaccine, hopefully it provides some relief and marks the beginning of the end of this tumultuous time for CRE office landlords.

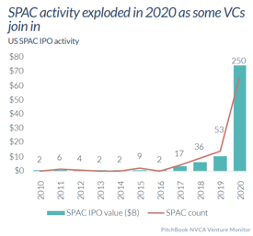

Trend: SPAC Mania

According to the NVCA, 2020 saw record capital raised by VCs ($73.6B), record investment into startups, and the 2nd highest year for VC-backed exit value on record. It’s worth noting that ~2/3 of venture dollars found their way into later stage deals, with some hypothesizing that the volume of later-stage investment has increased potential exit pressure, as well as tension between private and public market investors. Of late, this has been coming to a head with a massive uptick in SPACs as an alternative to a traditional IPO, with ~250 SPACs raised in 2020 representing a value of >$75B, exceeding the amount of capital that VCs raised in the year and up meaningfully from the 39 SPAC business combinations produced in 2019. Q3 alone produced SPACs totaling almost $51B. Of the 247 SPACs announced, as of 1/22/2021, 204 of them have yet to announce a transaction. Those dollars are hunting for targets.

In the PropTech space, some notable companies that went public via SPAC are Porch and Opendoor, while Latch was recently announced, and WeWork is also allegedly looking like it will SPAC soon. Latch will be taken public via a Tishman Speyer SPAC, while CBRE, Fifth Wall, PropTech Acquisition II ($200M), Spencer Rascoff’s Supernova Partners ($350M), Simon Property Group ($300M), Property Solutions Group ($230M), and Lionheart Acquisition ($230M) are all hunters that are being spearheaded by real estate developers, investors, or others in the ecosystem.

As an earlier stage investor, we can only speak to the SPAC boom with how we see it on the day-to-day, which is largely correlated with the seemingly insatiable demand from the public markets for more growth stocks. Anecdotally, earlier stage founders can point to the public markets as validation for lofty valuation expectations to combat the weariness of investors concerned with early stage risk in the COVID world. Despite the slowdown in early stage investments at the onset of COVID, we did see things return to normal quickly thereafter. While SPACs appear to address fundamental problems with liquidity and the traditional IPO process, the sheer volume of them – and continued emergence of more SPACs in 2021 that doesn’t appear to be slowing down – do create questions around the supply and demand between capital and targets. Economics of SPACs can also be called into question, as sponsors can be rewarded handsomely without corresponding alignment of incentives with things like longer-term value creation and/or stock appreciation. It will be interesting to watch the SPAC evolution, particularly which targets elect to go public via SPAC, the number and size of them, terms, and performance relative to traditional IPOs and/or direct listings.

Trend: Home Services & Renovation

While 2020 and 2021 focused on the evolution of business models and increasing digitization of process and industry, we also consider the “durable” markets that have been around a long time and that we expect will continue to be around for a long time. In this case, we’re referring to home services.

Home renters and owners are spending more time at home than ever, and the maintenance, improvement, and overall durability of our dwellings continues to be a massive market filled with pain points. There are consumer marketplaces that are challenging to navigate, minimal price transparency for work, large discrepancies in quality, analog and offline processes, and payments for materials and labor that put stress on homeowners and contractors alike. On the commercial side, SFR and multifamily portfolios are faced with scattered site management issues that arise from a lack of density and are at the whim of renters who are less incentivized to care for something they do not own. While we’ve seen startups target the space and picking off specific pain points, the scale of the market and potential for streamlined efficiencies are attractive to us as venture investors. Here’s a fun stat: per HomeAdvisor, Americans are completing approximately 511,345,000 home service jobs each year, or about 16 jobs per second. One startup that’s well positioned to take advantage of current market tailwinds is Outfit, a direct-to-consumer home renovation startup innovating the delivery of home improvement projects. It’s DIY kits not only provide a delightful customer experience but also improve cost structure to increase scalability.

The home services space spans service type, real estate asset type, consumer type, business models, customer size, and contractor size. It is an onion with a lot of layers. Business management software and marketplaces were the tip of the spear, but as Paul has highlighted several times, verticalized payment chains, visibility and transparency of pricing, quality, materials, and durability are also being targeted. We also see home services and visibility into the home as a massive opportunity for insurance companies to get smarter about how they underwrite risk and how they satisfy claims. New data can determine the real risks associated with a policyholder and their assets, as well as reduce and improve the quality and quantity of claims. Home inspection software startups such as Inspectify, Roofr and Spectora are well positioned to collect these new data clusters.

It’s worth noting that Nine Four has a unique value proposition to provide startups targeting the home services industry. Our bench is filled with LPs and people who have spent their careers in home services and watched the space evolve. They also understand the nuances in working with contractors and vendors, as well as the challenges with technicians performing their crafts. We have the ability to provide more meaningful access to experience, customers, and growth than many, and are very interested in hearing about any and all interesting ways to create value for the ecosystem.