While dividing ownership through REITs or equity shares is not a new concept, alternative investment startups are facilitating property transactions and creating new models for ownership in real estate.

Startups such as Pacaso and Fractional have made it easier for more people to own a home by splitting ownership into several different pieces as part of an LLC. Divvy, along with companies such as ZeroDown, Flyhomes and others, are creating new paths to homeownership through rent-to-own and all-cash purchase models. Cadre and Concreit are also delivering institutional-quality real estate through diversified CRE investment portfolios.

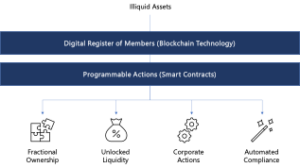

Over the past few years, there have been several projects bridging the worlds of blockchain and real estate that make property transaction management, ownership, and liquidity ripe for disruption once more. Non-fungible tokens (NFTs) have recently taken the world of art, music, and sports by a storm, and although slow to start, there are opportunities for tokenization in real estate. Imagine a world in which anyone could buy a house as an NFT, borrow against the NFT using decentralized finance “DeFi” products with high-yielding interest rates, and cut out intermediary banks altogether. This is the opportunity that tokenization of real estate through blockchain technology provides. Investors have poured over $90 million in funding into marketplaces like OpenSea, where artwork and a house in California recently went up for auction. Meanwhile, Republic Realm has launched an open-end fund targeting digital real estate.

Source: KPMG Real Estate Tokenization report (page 14)

Tokenized real estate is liquid like a REIT but also tradable to a diverse pool of investors on a true 24/7 peer-to-peer market that democratizes access regardless of ethnicity, age, or cultural identity. The average property transaction process is labor-intensive, expensive, and time-consuming. By “tokenizing” property rights, it becomes much easier to trade, creatively finance, and manage real property, time-stamped records of deeds, parcel numbers, and much more. Availability of tokens representing fractional shares of single assets unlocks value through diversification of real estate portfolios and lowers transaction costs that are typically paid to individual brokers. Propy’s novel software automates the antiquated system of real estate, from sale to title, to a blockchain-based, automated one so that brokers and agents can seamlessly close deals. RealT is a crypo startup that allows investors to buy into the US real estate market through fully-compliant, fractional, tokenized ownership on the blockchain. It is also working with Aave to let people stake their tokenized real estate as collateral to take out loans of stablecoins—cryptocurrencies pegged to a fiat currency, like the US dollar. SolidBlock is involved with the tokenization of assets, including in real estate. That means, first dividing an asset into shares that can be sold to investors; and second, digitizing or issuing these securities (tokens) on the blockchain. Within commercial real estate, Reinno has created a range of lending products including instant loans collateralized by tokenized commercial real estate, a mortgage refinancing program, and loan brokerage.

Despite these advancements, there are some challenges to adoption of this technology within the real estate transaction management and the securitization value chain that suggest change is likely to come gradually in the property sector. For example, there are threats of hacks to smart contracts, lost passwords, and SEC filing regulations. Mining fees on the Ethereum blockchain where most of these decentralized apps are being built remain expensive for the purchasing party; although, they are expected to decline after a version 3 launch of the decentralized exchange Uniswap. In addition to these challenges, there will also still be a need for property management companies to take care of maintenance, payments, and collection of rents.

While most proptech investors do not have heavy exposure to blockchain within their portfolio companies, an increasing number of real estate transactions will be taking place remotely online or sight unseen and the real estate transaction process will continue to digitize. Although VC-backing of entire asset tokenization in the near-term is unlikely due to heavy government regulation and resistance to broad-based adoption, there are currently some use cases of blockchain for parts of the property transaction management value chain. For example, San-Francisco based Figure founded by SoFi’s Mike Cagney has traded nearly $3 billion worth of loans and has successfully tokenized home equity line of credit (HELOC) and brought blockchain into the mortgage market. Earlier this year, JP Morgan provided Figure a $100 million financing facility to help with conforming and jumbo mortgages and Cagney filed for a $250 million special purpose acquisition company (SPAC) to identify blockchain tech companies that have compelling growth potential. Recently, Figure received approval from the Securities and Exchange Commission to become a broker-dealer and run an SEC-registered Alternative Trading System for digital securities custodied on the company’s Provenance blockchain. The new alternative trading system will allow Figure’s blockchain-based cap table management solution to offer secondary liquidity to private entities and asset issuers will be able to create security tokens on Provenance.

Although not on the blockchain, HomeTap, Point Digital Finance, and Peer Street allow homeowners to sell slivers of equity in their homes rather than refinancing or selling completely. However, they still involve traditional third-party service providers, such as banks and brokers that slow down transactions and increase prices. The true value of tokenizing residential properties comes from cutting out those middlemen by using smart contracts on the blockchain resulting in faster transactions with lower fees and less risk. Further, utilizing the blockchain, owners can access a wider pool of investors all across the globe without paying any fees.

Another example is recently-acquired Harbor, which digitized traditional alternative investments by allowing real estate assets to securely ICO and trade using a decentralized blockchain ledger. Although the vision was promising, in late 2019 Harbor’s deal to tokenize $20 million worth of student housing with the real estate arm of Chicago-based trading firm DRW Holdings fell apart. This was a reality check for token evangelists and it became clear that removing the friction from real estate deals with tokens would take time to attract institutional money. However, Harbor was later acquired by Bitgo then Galaxy Digital to recreate all parts of the traditional financial system and significantly accelerate the mission on DeFi. DeFi is a force to be reckoned with that has provided greater choice to consumers, stripped out costs from the legacy financial system, and brought greater liquidity and product innovation to capital markets. While Harbor was perhaps too early to the real estate market, I believe that the next decade will see increased tokenization of a wide range of assets, including the global CRE market.

If you are a founder or investor who would like to discuss further, please reach out!

By: Nicolle Lee (MBA Intern)