Single-family rentals have historically been considered a “niche” asset class dominated by smaller mom-and-pop owners and managers. This, however, is changing as institutional investors are increasingly interested in the space and deploying larger amounts of capital, both of which require new technology infrastructure and creative strategies to meet the growing demand. As a PropTech VC, we’re interested in backing startups that could benefit from supporting this trend.

Owning a single-family home has been one of the safest and highest returning investments relative to other asset classes.[1] However, institutions ignored this asset’s attractiveness since smaller purchase prices made it tougher to deploy larger amounts of capital quickly and efficiently. Single-family homes were also more challenging to acquire and manage at scale given their low density and scattered site locations. Additionally, SFR investment and management approaches were relatively foreign to institutions and few sophisticated investors had the knowledge, muscle, and teams required to properly scale an SFR strategy.

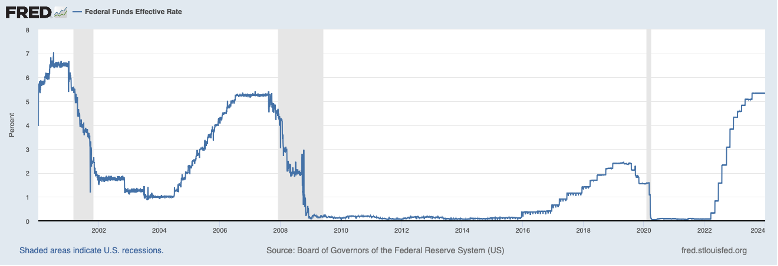

Things changed during the great financial crisis in 2008. Interest rates dropped to all-time lows and foreclosures increased to all-time highs bringing record amounts of inventory to market. That combined with a stock market crash negatively impacted the wealth of previously active mom-and-pop investors and prevented them from competing for new supply. That scenario created an attractive, less competitive opportunity for institutional investors to acquire inventories of solid assets at lower prices and create larger, curated portfolios for the first time, which are easier to manage and attract higher premiums at exit.

Interest rates at an all-time low during the subprime mortgage crisis[2]

US foreclosures at an all-time high during the subprime mortgage crisis[3]

Institutions like endowments, pension funds, and insurance companies wanted to take advantage of this new opportunity – accessing stable SFR cash flows and capital appreciation at scale – but didn’t know how to access them and didn’t want to actively manage real assets themselves. New players like Invitation Homes (ticker-symbol INVH, acquired by Blackstone), America Homes 4 Rent (also acquired by Blackstone), Pretium, Amherst, and SFR3, among others, noticed increasing institutional SFR interest and were willing to manage real assets. So they created the first SFR-focused asset managers that bridged the gap between institutional capital and SFR assets. Institutions hired and paid asset managers like INVH to be conduits for originating, underwriting, servicing, and managing SFR homes at scale. Asset managers leveraged the opportunity to cherry pick from an unprecedented number of foreclosures to buy homes with specific characteristics in particular MSAs to create bigger, higher density portfolios to attract premium valuations at exit to drive superior returns and drive down operating costs.

To put the insatiable institutional SFR demand in perspective, at the beginning of 2008, ~13% of the ~80M single-family homes in the US were rentals, but only a small fraction was owned by institutional players. That number grew to 700K in 2022 and could increase to ~7M by 2030.[4]

The tremendous growth in institutional SFR interest requires technology to deploy capital and manage assets efficiently. A variety of startups such as our portfolio companies Bungalow and Vontive, along with others like Entera and Kiavi, provide a menu of software-driven services ranging from origination to underwiring, servicing, and management. Bungalow and Entera operate tech-enabled brokerages and data analytics platforms that help asset managers identify overlooked, underinvested, and less competitive markets, neighborhoods, and homes for favorable acquisition opportunities. Some have even vertically integrated and handle property management responsibilities too. Vontive and Kiavi operate tech-enabled asset managers that streamline capital into investment mortgages and construction loans for institutions that want access to stable fund flows from single-family home rentals and remodels.

Nine Four portfolio companies Inspectify and SmartRent focus on streamlining the management of portfolios leading to reduced operating costs, increased tenant experiences, and unique differentiation. Inspectify structures data from inspection reports across portfolios to drive capex, reserve, and operating efficiencies. SmartRent offers an integrated smart access management platform that streamlines deliveries, self-tours, parking, and leak detection. As more and more institutional capital enters the space, we expect the need for additional scalable technologies and the amount of founder and investor attention to increase simultaneously.

As the institutional SFR investor wars heat up, players are looking for advantages, especially as the gap between the bid and ask spread remains wide. One potential angle is to deploy capital earlier in the lifecycle of an SFR asset before others can. Rather than waiting to acquire an existing home, some institutional investors are exploring a new derivative of SFR called BTR (aka Build-to-Rent). This strategy involves building homes, holding them after completion, and renting them to tenants. BTR investors are building smaller, less expensive homes that are more in line with current market conditions. Although it requires a different skill set, BTR interest is growing quickly, and players are adjusting accordingly.

Institutions that have already raised new SFR funds but haven’t yet deployed them could be licking their chops. If rates decrease but remain elevated relative to where they were, they could drive more inventory to enter the market. Lower but elevated rates combined with more inventory, certainty from the Fed, and less competition from consumers could create an enticing investing environment for institutional investors in 2024 like the one in 2008. This also points to opportunities for PropTechs.

A potential wrinkle in the SFR and BTR industry is regulation, particularly in areas with affordability issues. Recent legislation has been proposed to eliminate hedge funds from owning single-family rentals, for example, and there is increasing concern about institutional dollars taking inventory off the table and further increasing prices for interested buyers who would be living in the homes.[5]

No matter where legislation goes, however, we still believe that technology solutions to help maintain and manage homes will remain, whoever the owner. Management is an interesting frontier between the physical and digital worlds, and we’re excited about startups pushing that frontier.

The information provided in this blog is not intended to be financial advice or solicitation for any purchase or sale of securities. Investing in securities entails risk, including the risk of principal. Some of the information presented has been provided by third parties, has not been independently verified, and is subject to change without notice. The opinions stated are the opinions of Nine Four Ventures at the time of publication. Past performance is not a guarantee of future returns.

[1] The Rate of Return on Everything, 1870-2015

[2] Federal Reserve Bank of St. Louis, accessed January 2024

[3] U.S. Foreclosure Activity Continues To Climb In Q1 2023, April 2023

[4] CNBC: How Wall Street Bought Single Family Homes and Put Them Up For Rent, February 2023

[5] New Legislation Proposes to Take Wall Street Out of the Housing Market, December 2023