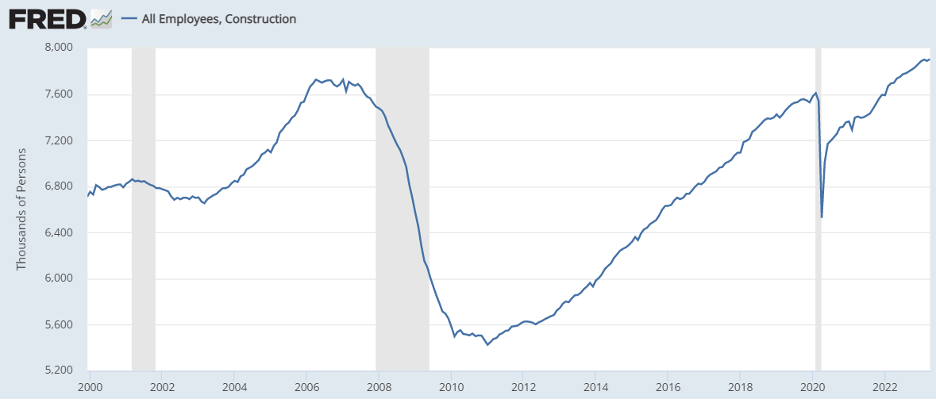

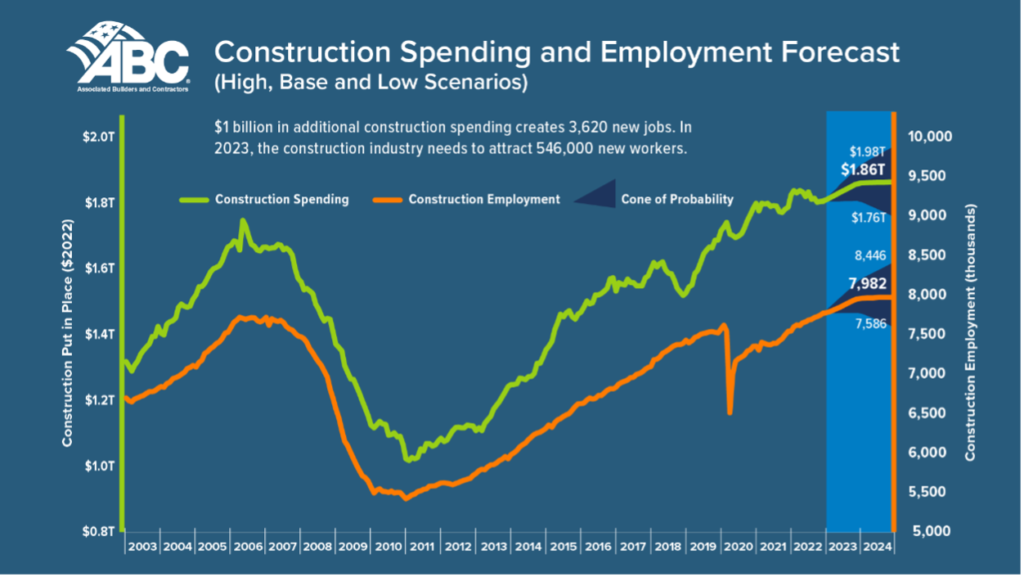

The construction industry is massive. It represents an $8T global market and is one of the world’s top ten employers[1]. Although it plays a critical role in the economy, the industry is being plagued by a noticeable labor shortage, despite being at an all-time high for employment.

According to the Associated Builders and Contractors, “The construction industry will need to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet the demand for labor.” This leaves construction at a daunting crossroad. The world needs more infrastructure and housing, but it’s challenging to meet those demands without the required manpower in the expected period of time. Technology powered training programs and productivity software applications represent logical, scalable, and capital efficient solutions to help solve this problem.

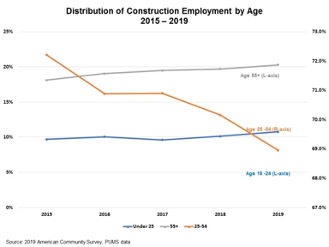

Much of the labor shortage issue can be seen as starting from the building blocks of public education. Decades ago, many high schools across the US sponsored woodworking as an elective to introduce students to skilled trades early on. Students who had a knack for building and a love for engineering could go into the trades and make a comfortable living for themselves and their families. Today, woodworking is a thing of the past and commonly no longer offered in most high schools. Perhaps this is a sliver of what it looks like for an economy transitioning into the Information Age and digitization across almost all industries – except the built world. Today, the need for skilled trades still exists, but young people aren’t as exposed to these professions like they were before and aren’t replacing an aging workforce, primarily comprised of Baby Boomers, as they retire at an increasing rate.

Some startups have noticed this trend, and, in an attempt to reverse it, have created in-person, online, and hybrid training programs for students to i) enter the trades with little or no prior experience, ii) improve existing skills within the same trade, and iii) re-train and move from one trade to another. Faraday, Greenwork, InterPlay Learning, Skillcat, and Workrise all offer different yet promising training angles and flavors to help close the labor shortage gap.

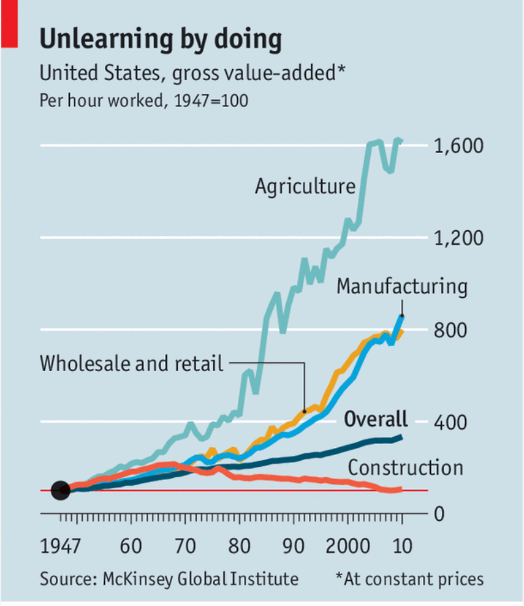

It’s unlikely the construction industry will soon close the labor gap entirely with people, so technology applications that can improve the productivity of tradesmen and women can help fill the residual void. However, that’s a lot easier said than done. The construction industry is perennially one of the slowest to adopt new technology resulting in less pronounced productivity gains and illustrated in the graph below.

This could be driven by a few factors. First, no two assets and/or projects are the same, so it can be difficult to automate any workflow completely or at least as much as workflows in other economies like IT. With that in mind, purpose-built software applications that integrate with existing systems to pull and push data seamlessly, and without requiring additional manual data entry will be imperative to not only market adoption but also value creation. Second, the construction industry involves the development of real assets which requires humans, equipment, and tools. Software can tell us everything we want to know about a lightbulb, electricity, how it works, and how to replace one, but it requires being physically present to do so.

Further, software can’t build homes, but it can inform the materials used, processes to follow, and design trends, whereby making software users, tradesmen, and women, more efficient. Third, there are fears and frustrations around such things as duplicative data entry for both office and field staff. The construction industry is already filled with large amounts of manual data entry which requires significant time, so adding duplicative work and having to learn new systems potentially adds redundancies and even more lost time to already packed days and understaffed projects.

The current economic climate is posing a number of challenges for the industry, including rising interest rates, inflation, and construction project costs. These challenges are putting pressure on construction firm’s margins, which are already slim. The average profit margin in the US construction industry is just 3.4%[3], and this is made worse by the industry’s typical level of inefficiency, which is between 20% and 30%[4]. According to Deloitte’s “The Future of Construction” study[5],

Changes in customer demand, the nature and economics of construction, and the realities of the modern supply chain have led to fundamental shifts in the way E&C firms tend to do business. Construction is no longer simply about building unique structures and physical infrastructure. Fundamental shifts are happening that can push E&C firms to explore radically new ways of creating and capturing value as they make the leap toward the fourth industrial revolution.

One of these fundamental shifts is “Smart Operations”, which includes “data-driven decisions that drive dynamic scheduling and reduce budget and scheduling variances”. According to FMI (the Consulting and Investment Banking firm) , 96% of data in the construction industry goes unused and 13% of total staff hours are spent looking for project data and information[6], but with so many headwinds for the commercial and residential construction market, it is critical for the construction industry to use data in an efficient and meaningful way.

In order to better understand the opportunities for data driven decisions, construction firms must look to their largest employment pool, field labor. According to FMI, Tracking Equipment and Productivity Measures is one of the four (4) ways to leverage data across the industry.

According to IBM[7], “Effective field service management solutions integrate data from enterprise asset management systems with remote data from the field — including IoT and mobile devices”. Some of these benefits of field service management include:

- Increasing uptime: Identifying necessary repairs earlier in the asset lifecycle for always-on operations, high levels of performance and reduced downtime.

- Shortening mean time to repair and improving first-time fix rates: Ensuring the right team member is assigned to the job and provide them with the right data at the right time on a single platform.

- Empowering field service team members: Provide these team members with remote assistance and mobile capabilities that help them to stay safe, be compliant, troubleshoot and complete work tasks efficiently.

- Reducing field service costs: Use data and insights to complete maintenance tasks at the right time and in the most effective and efficient manner.

- Increasing customer satisfaction: Know if technicians are meeting customer expectations and respond promptly to concerns or unexpected delays.

As the labor gap continues to widen, it is imperative that construction companies use data in a way so as to optimize their labor force.

Bridgit, Kojo, and OpenSpace are Nine Four portfolio companies dedicated to developing software that lead to more efficient use of personnel and time. By optimizing workforce planning, streamlining materials ordering, and improving collaboration, these companies are helping to reduce human error and potential downstream delays in the E&C industry. Bridgit is a workforce planning software that provides real-time visibility into the workforce. This allows construction companies to identify potential gaps in manpower and skills ahead of time, which can help to reduce downtime and hiring issues. Bridgit also integrates with other construction software, such as accounting and project management tools, to provide a holistic view of the project. Kojo is a materials ordering software that helps construction companies to streamline their ordering process. It provides a single platform for ordering materials from multiple vendors, and it integrates with accounting software to track spending. Kojo also helps to reduce the need for manual data entry, which can save time and improve accuracy. OpenSpace is a 3D imaging software that helps construction companies coordinate their work in real time; Teams can share files, chat, and collaborate on projects. OpenSpace also helps improve communication and visibility, which can lead to more efficient project execution, ultimately saving time and costs. All of these portfolio companies are working to improve the efficiency of the construction industry. By developing software that helps companies to optimize their workforce, streamline their materials ordering, and collaborate more effectively, they are helping to reduce costs, improve safety, and shorten project timelines.

Construction is facing a number of challenges like all other massive industries. However, there are many exciting opportunities for technology to improve the productivity of existing workers, and attract and train new entrants to help close the labor gap in a shorter period of time. As a result, it will be fun to watch how the space evolves and see which players separate themselves from the pack. If you’re building in ConTech and focused on solving these pain points, please reach out! We’d love to connect and learn more.

By: Lauren Celano (MBA Associate Intern) with help from the Nine Four Team.

DISCLOSURE INFORMATION

This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risk associated therewith and any related legal, tax, accounting, or other material considerations.

[1] Statista Research Department, “Global construction market size from 2020 to 2021, with forecasts up until 2030,”2022

[2] The Economist, “Efficiency eludes the construction industry,” 2017

[3] IBISWorld,” Construction in the US industry trends (2018-2023),” 2023

[4] John Biggs, “Can Innovating Slowly Help Speed Up Construction Technology Adoption?,” 2022

[5] Deloitte, “The Future of Construction,” 2021

[6] FMI, “Big Data = Big Questions for the Engineering and Construction Industry,” 2018

[7] IBM, “What is field service management?”

[8] ABC, “Construction Workforce Shortage Tops Half a Million in 2023,” 2023