Goodbye 2022, and hello 2023!

Most founders and investors would agree that the last four years have been a rollercoaster, going from relative stability in 2019 to doomsday in 2020 to irrational exuberance in 2021 to a recession in 2022. As a first-time fund manager, the silver lining is that we’ve probably seen more cycles in a few years than most managers had in the prior ten. However, a stable refuge would be welcomed in the wake of extreme volatility driven by inflation running amok, rapidly rising interest rates, supply chain challenges, labor shortages, and global conflicts.

Last year around this time, 2022 was facing an uphill battle to top an unprecedented 2021 that brought a record-breaking number of IPOs of long-time tech community darlings such as Airbnb, Coinbase, and DoorDash. Over one thousand IPOs raised hundreds of billions of dollars in proceeds and created mind boggling amounts of liquidity for shareholders.[1] Record-breaking amounts of capital flowed into the tech ecosystem, which led to the most deals and venture capital dollars ever deployed in a single year, representing almost twice as much as the previous record set in 2020![2] Investments were getting done at a torrid pace with limited due diligence, everything was going up and to the right, and no one could do any wrong. All boats rose in that rising tide, but as the great Warren Buffet says, “it’s only when the tide goes out that you learn who has been swimming naked.”

Hindsight is 20/20. Now that we’ve all come crashing back down, it seems so obvious that the loose monetary policy of the US central bank during the previous decade and the fiscal policy of the US government during COVID-19 would catch up to us. However, it was tough to imagine rising inflation and interest rates would impact the economy as quickly and deeply as they did. The retrenched capital markets, slower growth, and layoffs are unfortunate byproducts, and a 180 from what we were experiencing just 12 months ago, but serve as an important reminder that one thing is for sure: the only constant is change. The founders and investors that remain vigilant, flexible, and disciplined are well positioned to weather the storm.

As Nine Four Ventures looks around at all the things happening in startup land, crypto, and the metaverse, we feel fortunate to be investing where we are. The built world and the industries that interact with it are the largest and oldest industries in the world, are well understood, and aren’t going anywhere. Although the markets we’re investing in may be considered “safer” compared to others, they still represent attractive opportunities to generate strong returns, in part because of their size and relative nascency of tech and software adoption. There are also some tail winds that impact PropTech and may take the edge off of the current recession’s blast radius, and position real estate, its related industries, and PropTech to be more resilient than other areas:

[1] Nasdaq, January 2022

[2] Statista, March 2022

- COVID-19: As terrible as COVID-19 has been for everyone, it forced traditional real estate incumbents across the landscape to pilot and buy more cloud-native, integrated software to replace offline, inefficient paradigms. From what we’re seeing and hearing in the marketplace there’s a low probability that trend will reverse course, but the bar for new early-stage startups is certainly higher today than it was in 2021 given tightened IT budgets.

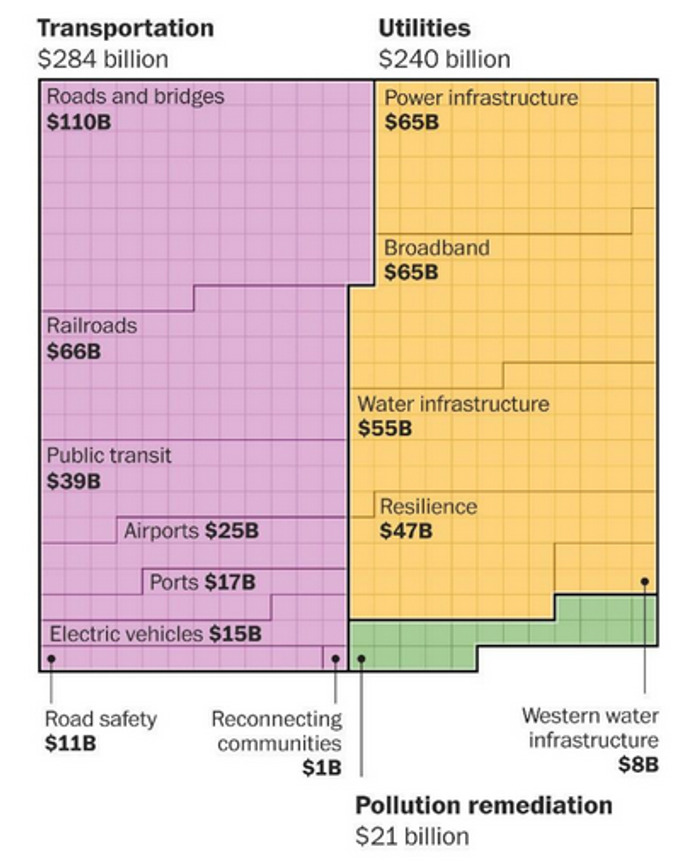

- Biden Infrastructure Bill: President Biden’s $1T+ infrastructure bill passed and earmarked ~$550B in new transportation and utilities investment. [1] It’s still early in the capital deployment cycle, but lenders, builders, and suppliers across the ecosystem should be positively impacted by the influx of capital, and PropTech startups are well positioned to create efficiencies that make the deployment of this spend more impactful.

[1] Congressional Budget Office

- Global Climate Crisis: we’re facing an existential global climate crisis. In an effort to curb real estate’s ~33% contribution to all greenhouse gas emissions, governments in Europe and local municipalities along the US eastern seaboard are putting laws in place that force owners to comply with new ESG standards in the next few years. That doesn’t leave a lot of time and creates immense opportunity for startup innovation to fill the voids and needs being created by this new legislation.[1]

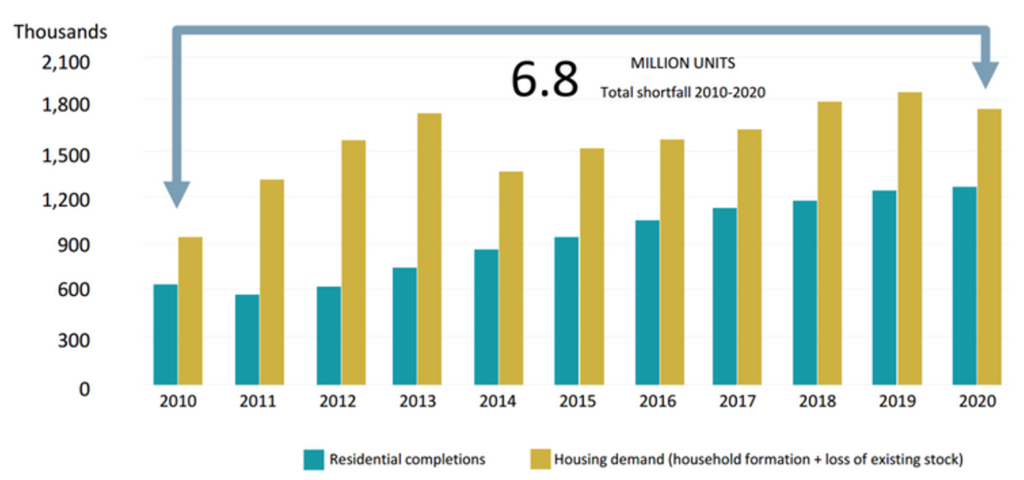

- Housing Crisis: we’re facing a global housing crisis and the US alone has a shortfall of 6.8M units. Housing remains a critical issue and although material costs have skyrocketed and labor is scarce the world needs more homes quickly and affordably for its fast growing population.[2]

[1] McKinsey & Co

[2] US Bureau of Labor Statistics, October 2021

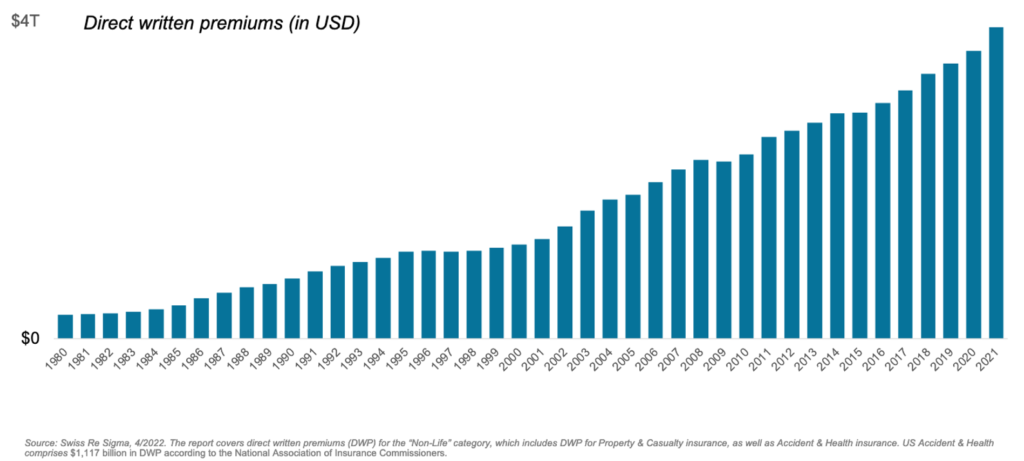

Segments such as CRE office and single-family homes have been meaningfully impacted, but other built world pockets are considered more resilient. For example, insurance tends to be more sheltered from broader macro environments because every stakeholder, from lender to vendor, needs insurance protection whether times are good or bad. Further, as the world’s population grows and weather patterns become more severe, property & casualty insurance claim values and volumes have and most likely will continue to increase proportionally. In addition, claims create work orders which are the lifeblood of many home services companies, suppliers, and OEMs that represent markets worth hundreds of billions of dollars.

Similar to our PropTech Trends from last year, we believe the companies best positioned to win in 2023 will be those that unlock increased productivity, leverage high margin, have low capital intensity, recurring business models, and improve cash management and operational efficiency while staying vigilant and flexible (sounds easy, right?). While we remain focused on those company characteristics, we’ve also doubled down on markets such as construction, financial services, insurance, and real estate operations.

We don’t know what 2023 has in store, but hopefully lower inflation and tapered interest rate hikes will bring a year of more certainty and stability. Despite the chaos around us, we continue to be excited about PropTech’s future. PropTech impacts the biggest industries in the world that are real and aren’t going away. There are long-term tailwinds offsetting short-term headwinds, recession resilient market segments, stakeholders with unique influence, and sectors insulated from big macro swings.

Although the trends outlined below have a slant towards where we focus our time, we hope the discussion provides a comprehensive overview of the exciting developments we experienced in 2022 and what we expect to happen in 2023. Hopefully this serves as inspiration for founders thinking about building new startups or stakeholders considering adopting new technologies. It goes without saying, but if you have any feedback, comments or questions please get in touch!

Trend: Construction FinTechs Creating Cost and Operational Efficiencies

Back in 2018, our LPs at the intersection of financial services and construction tipped us off to massive markets that were still largely operating offline. We then tracked the flow of funds from lender to vendor and discovered a legacy analog payment paradigm full of middlemen and layers. These extra inefficiencies and complexities created low visibility, long turnaround times, slow repayment periods, cash flow crunches, and misaligned incentives for stakeholders operating up and down the value chain. We continued our dive and eventually landed on construction loans, which start with lenders at the top of the payment chain. These loans are considered much riskier than mortgages and are paid out across multiple disbursements called ‘draws’ rather than a single, complete, upfront payment to the borrower. The draws are based on pre-determined progress milestones. Today, lenders rely heavily on in-person inspections to confirm jobsite progress such as the amount of framing installed compared to the timeline and budget. Inspection confirmations are communicated to lenders and cross referenced with a complex web of invoices, lienwaivers, and approvals through a mix of PDFs, emails, and spreadsheets from different contractors. Manual reviews take weeks, sometimes longer. Assuming all Ts are crossed and Is are dotted, loans are approved and disbursed to developers, who then pay their general contractors, who then pay their sub-contractors, who then pay their suppliers, who then pay their OEMs and retailers. This is a contributor to why it can take 120+ days for downstream stakeholders to get paid, and creates problems for ecosystem participants already plagued by razor-thin margins. Contractors need to buy materials to finish projects they were hired to complete with limited cash and few, if any, financing alternatives.

Although significant improvements have been made through 2022, there is still a long way to go. As interest rates rose in 2022, it became increasingly important to have real-time visibility into the existing and expected performance of loans for both lenders and borrowers, especially those exposed to floating rate debt. This drove demand higher for construction finance software, and contributes to why cloud-native, integrated risk controls like Nine Four portfolio company Built Technologies were and continue to be well positioned in this market while many play defense and protect against downsides.

Outlook:

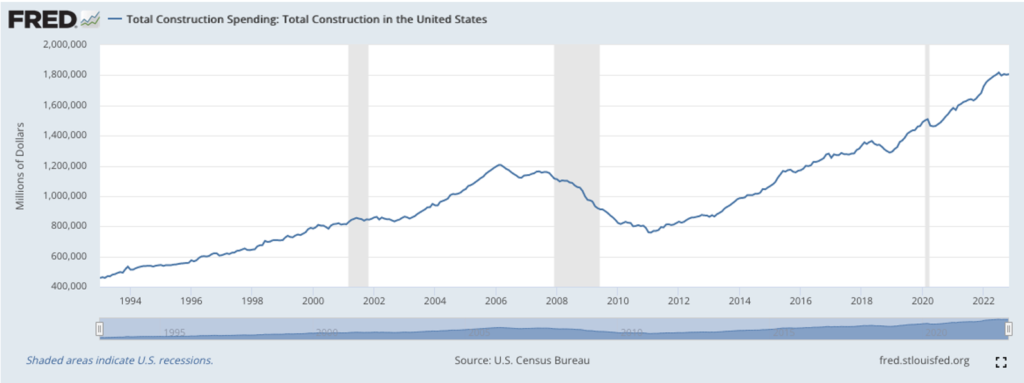

Construction spend flattened in 2022[1], but Nine Four’s construction related software companies were some of the fastest growing and most operationally efficient in our portfolio. Their encouraging resilience could be supported by multiple drivers including insulation from small market shares in massive markets and the built world’s substantial need for more housing. That said, perhaps the effects of rising rates are laggards and have yet to be felt.

[1] Fred Total Construction Spending, December 2022

Looking to 2023, we still feel as though the industry is in the early innings from an adoption standpoint. There will always be some tension between the software that lenders use and push down to their borrowers, but now that GCs and subs are experiencing how these platforms can help all stakeholders combined with a generational shift from Baby Boomers to Millennials, we’re starting to see adoption tick up that points to a potentially exciting next few years in this space.

Trend: Consolidation in Virtual Data Capture

While working with Built Technologies, we discovered the critical role inspections play in the construction process, which led to our subsequent investment in market leading company OpenSpace. In its simplest form, it offers “Google Street View” for construction sites. We also view OpenSpace as a virtual inspection system-of-record for the industry. A project manager attaches any off-the-shelf 360 camera to his or her helmet, and as he or she walks a jobsite, OpenSpace’s application takes pictures, uploads them to the cloud, stitches them to the floorplan of a blueprint, and creates a 3D model of what the jobsite actually looks like. Further, it compares what’s been built vs the original plan to help prevent change orders and automatically calculates how much drywall, framing or plumbing has been installed. Fully replacing human inspections is unlikely, however, OpenSpace’s back-end infrastructure technology is game-changing because it helps to expedite the flow of funds from lender to contractor without sacrificing compliance or increasing risk by transitioning offline workflows to an integrated, cloud-native platform.

Outlook:

Video Data Capture (“VDC”) was a competitive space when we originally invested back in 2020. There were players such as Avvir, Doxel, Holobuilder, Newmetrix (fka Safesite), and Structionsite, among others, offering what looked like a commodity virtual inspection product. That level of competition implied market dynamics like low barriers to entry and little differentiation which can make it challenging to grow efficiently. Fast forward to 2022, some broke out as stand-alone companies while several were acquired by strategics: Drone Deploy acquired Structionsite, Hexagon acquired Avvir and Oracle acquired Newmetrix, indicating that the market is maturing and collapsing into a consolidation phase. Those stand-alone companies and business combinations with the largest balance sheets and greatest operational efficiency are best positioned to survive.

Trend: SaaS-Enabled Platforms Continue to Thrive

What makes us excited about the futures of companies like Built Technologies and OpenSpace is the data they’re collecting and the robust platforms they’re building. For example, OpenSpace can analyze a contractor’s quality of work and if it finished a project on time and on budget. Those are critical data points that can distinguish an efficient contractor from an inefficient contractor, and who to lend to or insure. That level of data is a trojan horse that could enable OpenSpace to embed itself into payment, financing, or insurance flows in the future.

Built Technologies and OpenSpace are both great examples of how vertical SaaS platforms lay tremendous foundations on which FinTech, InsurTech, and marketplaces can be embedded within or layered on top. Their comprehensive product roadmaps and offerings can increase wallet share and reduce churn. Further, as FinTech, InsurTech, and marketplace gross transaction volumes (“GTV”) grow, so can demand for additional software from customers. This creates an attractive flywheel effect: more software consumption leads to greater GTVs and greater GTVs lead to more software consumption. This virtuous cycle leads to larger TAMs, faster and more efficient growth, and more complex activity systems that increase differentiation and competitive advantage over time.

Outlook:

This strategy helped OpenSpace attract a $100M Series D round in 2022 and is why we’re excited to continue to invest at the intersection of vertical SaaS, embeddable financial services, and insurance infrastructure in 2023 and beyond. You can read more about our thoughts on SaaS-enabled marketplaces and FinTech in our previous blog posts here and here.

While lots of reasons impact the success or failure of outcomes, it’s not surprising that the SaaS-Enabled platforms in the Nine Four portfolio were some of the best performing companies in 2022. We expect these platforms to continue to outperform relative to other models in 2023.

Trend: Material Procurement and Financing Comes Down-market

The global supply chain shocks created by COVID-19 in 2020 spilled over into 2021 and continued in 2022. Every stakeholder, no matter how big or small, from owner to vendor has been forced to adapt to backlogs and manage delays. However, few are feeling the pain of lingering uncertainty more than contractors.

Outlook:

Contractors use cash or expensive financing alternatives to purchase materials they need to complete jobs. Contractors are incentivized to work fast so that they can do more jobs and make more money, but long lead times from distributors, suppliers, and OEMs often slow them down. Although contractors are being hit hard, arguably no one has felt the brunt more directly than developers. At the end of the day, many costs can be passed through to them and they are the ones responsible for answering to their investors about changing IRR targets. If startups like Nine Four portfolio company Kojo help developers keep jobs on time and budget, they will benefit from their influence over downstream contractor customers. As long as inflation persists and material costs remain high, we believe PropTech procurement platforms across trades, segments and material types are well positioned for market adoption in 2023.

Another area that we believe has potential in 2023 is around net term financing. “Net terms” is a phrase used to describe deferred payment terms offered to customers who are seeking extended periods of time to pay for goods or services. This is real estate’s version of the tech industry’s Buy Now Pay Later (“BNPL”) and is a frequently used credit product commonly offered by suppliers, distributors, and OEMs to contractors. Given the weeks and months between when contractors buy materials and get paid back by owners, net terms provide the credit needed to “float” contractors until they can pay suppliers for materials.

As interest rates rise and the cost of capital continues to increase in 2023, it could have unfortunate consequences on the financial health of SMB contractors. Similar to construction loans, it will become increasingly important for suppliers in 2023 to transition their credit risk controls from static spreadsheets to cloud-native, integrated platforms like Nuvo to provide more real-time transparency into the current and expected performance of their portfolios. More information is better than less in a rapidly changing environment and optimization software like Nuvo and Rundoo can help stakeholders across the materials market make more-informed, data-driven business decisions.

Trend: Insurance Claims Continue a Transition into the Digital Age

Insurance continues to be a major area of focus for the firm. Rather than focusing on well-funded and more mature insurance sectors (e.g. pricing, underwriting, and analytics), Nine Four has been investing in more traditionally overlooked areas such as claims management and the claim payment chain.

Our initial interest in claims goes back to conversations with our LPs and broader network that highlighted 1) significant underserved needs in the industry and 2) how many service-based businesses were trying to win more claims work. In the claims space, there wasn’t and still isn’t an integrated, cloud-native system of record that tracks which contractor(s) worked on what job, the quality of work done, the materials used, how much it cost vs budget, and how long it took vs schedule. There’s so much valuable data that has yet to be structured that could have a meaningful impact on the absolute number and dollar value of future claims and subsequent profit margins of insurers. For example, if an insurer could track and compare the type of materials used against future performance and geography, it could theoretically run correlations to inform them which materials have longer useful lives and lower failure rates. Then, insurers could use that information to recommend specific materials to owners and contractors to reduce the probability of future claims.

The absolute number of insurance claims created and attached work orders generated every year is staggering, and the dollars associated with them are mind numbing. Similar to lenders, insurers play a foundational role in how money flows through the claim payment chain. Every transaction involves an exchange of money between counterparties that begins with insurance companies at the top. This creates leverage for insurers to influence the flow of funds all the way down to vendor – who gets paid what, when, where, and how – and the software downstream stakeholders use in order to transact. The larger the insurer, the greater the influence.

Outlook:

Valuable technologies like the ones being built by Nine Four portfolio companies Assured, Handdii and Inspectify can help reduce costs and create new revenue streams. Claims have historically been a major cost center for insurance companies, and leveraging new software platforms and structured data could help insurers create opportunities to reduce claims and generate new revenue streams. As mentioned, claims also create valuable work orders that fuel many downstream stakeholders. Insurers could ideally sell new structured data on materials used, expected useful lives of appliances, etc. to partners such as warranty providers and home services professionals for preventative maintenance orders to stay ahead of claims. In addition, this could provide a more seamless and improved policyholder experience and increase the likelihood of renewal.

Population growth and more severe weather patterns (e.g. hurricanes, wildfires, tornados) weren’t new in 2022 or in the years leading up to it. However, as the world’s population continues to substantially grow, material costs continue to increase, and global warming challenges persist, we expect premiums and the absolute number and dollar value of claims to increase proportionally. Using technology as a force to reverse this trend in 2023 and beyond will be a growing priority for every insurance company and a major opportunity for startup founders.

A new crop of InsurTechs including Nine Four portfolio companies AgentSync and TrustLayer and other startups such as Ascend and Comulate are building valuable technologies that reduce the amount of friction between stakeholders and expedite payment flows. Momentum grew in 2022 and should continue to grow in 2023 from founders, investors, and customers for accelerated payment solutions because they help insurers, brokers, and contractors get paid faster and structure data within purchase orders, invoices, and receipts associated with claims.

Trend: Next-Generation Digital Lending and Banking Platforms Emerge (…even in a high rate environment)

Banking and lending are in Nine Four’s DNA. We’ve noticed that many startups were initially focused on lending to consumers because it’s considered easier than lending to small businesses. Lending to small businesses is more complicated, more regulated, and requires more integrations. As a result, it requires more upfront knowledge, capital, and resources. Thus, we believe there is an overlooked, green field opportunity to build challenger bank brands purpose-built for historically underserved and often neglected small business segments in 2023 and beyond.

Outlook:

Looking ahead to 2023, we’re interested in continuing to partner with startups such as existing Nine Four portfolio companies Ease Capital, Vergo, and Vontive, and others such as Sagewell and Topkey that aspire to leverage data, technology, and white-glove support to streamline the lending and banking processes. The strategy is to create the infrastructure for rigorous upfront diligence and risk assessment to reduce underwriting costs, improve pricing, and offer a better borrower experience. Also, as the number of banking platforms and tech-enabled lenders continues to grow, we expect more opportunities for startups such as OatFi and Nine Four portfolio company Finley to automate critical, yet non-core, back-end infrastructure functions.

Trend: Multi-Family and Single-Family Rental Data Integration Layers Show Promise

Most, if not all, MF and SFR PropTech vendors rely on data in PMSs to provide the solutions they are paid to deliver. However, data is frequently challenging to access and messy to work with so vendors are forced to build expensive custom integrations and spend time “cleaning” data before it can be used. Using purpose-built APIs, startups could be able to automatically integrate with PMSs, audit and standardize data, and save valuable time, capital and engineering resources.

Outlook:

We were tipped off to this opportunity by our portfolio companies operating in the MF and SFR sectors who were finding it difficult to work through the pain of manual, bespoke integrations between PropTech vendors and PMSs. The MF and SFR PropTech markets are evolving: the velocity of growth for an increasing number of PropTechs is impressive, yet too often upstarts run into scale limitations due to their inability to efficiently manage mission critical back-end data integrations, cleaning, and auditing. This creates a parallel challenge of needing to scale a PropTech company and a data infrastructure function. It’s hard. New API startups could help alleviate this burden by delivering “data-infrastructure-as-a-service” for MF and SFR PropTechs to scale more efficiently.

Enabling API technologies solve data problems for not only PropTechs but also institutional real estate owners. Owners already use myriad different cloud applications to manage everything from leasing to marketing, maintenance, accounting, energy, etc and are becoming more open to the idea of outsourcing additional backend functions to startups, especially if it results in cost savings, higher net operating income and increased portfolio value. This significantly expands the total addressable market for API startups to a broader set of industry participants beyond IT and to traditional incumbents.

Trend: New Players in the ESG Space Improve Double-bottom-line Returns

The built world is a major contributor to global warming and contributes ~33% of all carbon emissions every year.[1] In an effort to curb real estate’s impact on the earth’s climate, governments in Europe and local municipalities particularly along the US eastern seaboard are putting laws into place that force owners to comply with new ESG standards over the next few years. This doesn’t leave a lot of time or options for owners and managers.

Outlook:

A challenge is that analysis, procurement, and reporting solutions are lacking. There simply aren’t efficient and accurate ways to analyze, procure, and monitor the projects, materials, and data that will be necessary to comply with new standards. No two assets are the same so owners and managers need dynamic software tools to analyze buildings individually, assess from a menu options what renewable alternatives are the right fit, and calculate what the range of costs and potential returns might be over time. Once appropriate renewable options are selected, access to white-glove or self-managed marketplaces will be needed to procure OEMs, suppliers and installers of materials and equipment. And after installation is completed, reporting at the building and portfolio level will be needed to report data to local governments.

This creates immense opportunity for startup innovation to fill the voids being created. The hardware needed for ongoing compliance and monitoring will require an expensive capital outlay that will force cash from the hands of owners into bank accounts of startups. As more laws are passed and deadlines are set, the pressure to conform will intensify. Fortunately, startups such as Cambio, Lumen Energy, and Tierra Climate are all taking advantage of these tailwinds and helping alleviate the burden of adopting to rapidly changing ESG regulatory environments. We previously invested in enterprise smart home automation company SmartRent, which is now a publicly traded company, and are looking to make more in 2023.

Thank You and Please Reach Out!

A big thank you to our founders and partners whom we’re fortunate to work with. Many of the insights learned and much of the work we’re most proud of involves them. We have lots of gratitude going into 2023, and hope we can make your jobs a little bit easier every day.

Please reach out If you’re an industry stakeholder considering adopting new technology or a founder starting a new company. We would love to speak with you!

[1] PwC, Emerging Trends in Real Estate 2023