Since the 2008 Financial Crisis, over 25,000 FinTech startups have launched worldwide.[1] The financial services industry, once prone to slow, manual workstreams and grounded by physical infrastructure, is now a competitive battlefield between longstanding incumbents and lean, tech-enabled FinTechs. Over the past decade, consumer banking has undergone a significant behavioral shift. The modern, digitally-native generation, armed with mobile devices, now expect a seamless, digital experience for their banking needs. As FinTechs continue to grab market share, incumbents are feeling the pressure to respond to this behavioral shift, either through developing internal technology or partnering with FinTechs who can help them digitize their product offerings and improve customer experience.

General FinTech Market Map

[1] BCG FinTech Control Tower; Nine Four analysis

While technological advancements and consumer banking behavioral shifts have certainly fueled the growth and expansion of the FinTech landscape, the FinTech movement is also the result of several market forces converging following the Great Recession. Wall Street regulations, such as the Dodd-Frank Act and Durbin Amendment[1], reduced the power of big banks and opened up the market to new providers. FinTechs capitalized on a low interest rate environment to leverage their balance sheets, securing long-term debt from large financial institutions. Trust in banks eroded following the Great Recession, and FinTechs found new ways to bring value to the consumer, through increased access to capital, shortened transaction cycles, greater convenience, and better customer experience. Investors have poured in capital, over $1 trillion in the last decade[2], to FinTechs who offer lean operational structures and new value propositions. Over the last decade, 81 FinTechs have passed the $1 billion valuation mark[3]and companies like Stripe, PayPal, and Square have grown to become some of the largest financial institutions in the world.

However, in the last 12 months, FinTechs have been threatened by a sudden reversal of the economic environment that enabled their rapid growth. Investors have grown a bit more wary of FinTechs, most of whom have yet to live through high inflation or rising interest rate environments. Publicly traded FinTechs have declined in share price by 50-80% on average over the last 12 months, underperforming the Nasdaq and S&P 500.[4] As more FinTechs have gone public, underwriting models have faced greater investor scrutiny, and FinTechs are now out to prove that they can pay down debt and pivot to profitability while continuing to acquire customers and deliver on promises of better experiences.

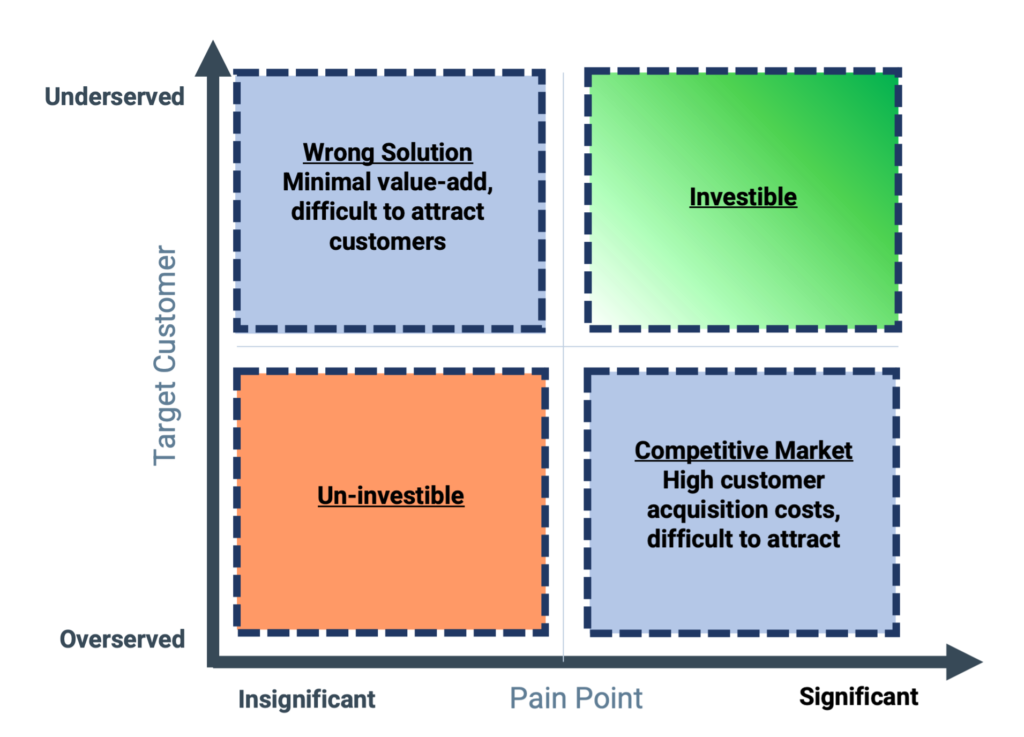

Not all FinTechs will survive the downturn. Despite record levels of dry powder, investors are in a ‘wait and see’ mode and have shown less willing in recent months to deploy capital to startups with high cash burn and no roadmap towards profitability. FinTechs spent a massive $3 billion on customer acquisition in 2020, evidence that increased competition has made it more difficult to find and service customers[5]. The FinTech landscape has grown increasingly saturated, with many solutions on the market that solve similar pain points. FinTechs that can survive the downtown and effectively scale to capture market share will be those that address significant, unsolved pain points with high operational efficiency, driven by unique technology and/or proprietary distribution, in underserved customer communities.

[1] The Dodd-Frank Act aimed to reduce deceptive and predatory behavior from banks on consumers. The Durbin Amendment capped interchange rates for banks with greater than $10B in assets, leveling the competitive landscape for FinTechs.

[2] Pitchbook Data

[3] Pitchbook Data

[4] Yahoo Finance

[5] Business Wire – 2020 is the last year this data was available

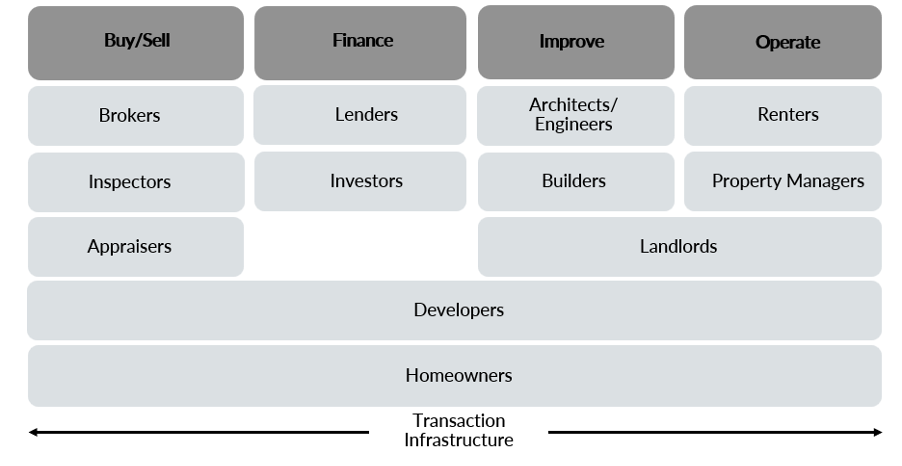

One exciting area of opportunity for FinTechs is in the real estate transaction cycle. In 2021 alone, $3.6 trillion was exchanged in the US from the acquisition and sale of real estate[1]. Despite the high trading volume, the real estate industry severely lacks the digital infrastructure to bring these exchanges online. While many transactions involve institutional buyers and sellers, such as commercial developers, institutional lenders, and private capital funds, many real estate stakeholders are individuals or small entities making high-volume transactions accounting for a significant portion of their net worth. These exchanges are lengthy, featuring frequent compliance checks and involving many stakeholders. Closing commercial or residential real estate deals often involve banks, appraisers, inspectors, brokers, insurance companies, and property managers, each with their own unique incentives and workstreams. Buyers and sellers struggle to navigate this fragmented landscape, relying on offline and insecure payment systems that are slow and inefficient.

[1] US Census Bureau, includes all residential and commercial property; Nine Four analysis

Real Estate Stakeholder Map

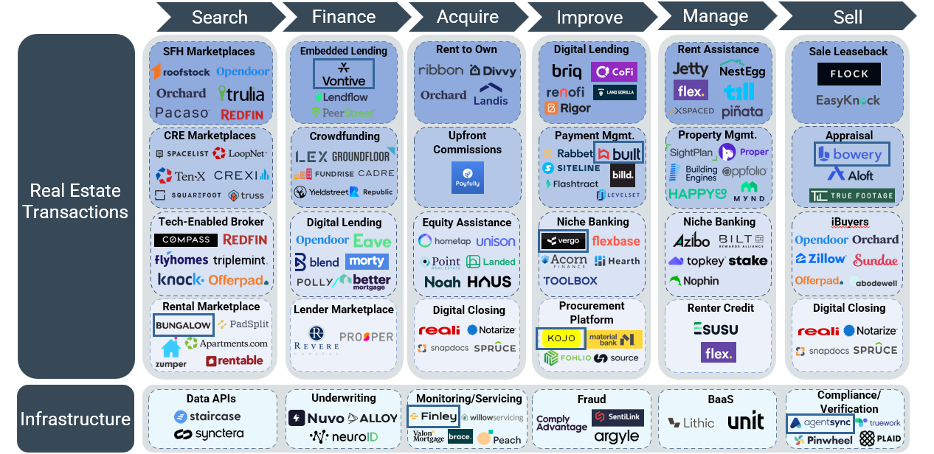

Lenders and investors, who sit at the top of the payment cycle, have a massive opportunity to accelerate and improve the real estate buy and sell experience. While some real estate-focused FinTechs, such as Quicken Loans, SoFi, and Opendoor, have emerged to capture market share in the residential lending market, big banks and other large financial institutions are still the biggest proportion of the real estate lending market. FinTechs can be powerful allies to these institutions as they pivot to faster, lower cost digital loan origination and execution cycles. Nine Four is focused on finding the startups that can partner with banks and other financial institutions to improve the FinTech infrastructure required for the digital exchange of physical real estate assets.

Nine Four portfolio company Finley, a debt capital management platform, automates the credit facility management process to centralize key deadlines, deliverables, and compliance information. Finley has partnered with banks and FinTechs to help them efficiently scale up their digital infrastructure, helping them reduce hiring needs and manual entry. Nine Four has also invested in Built Technologies, a construction loan draw management platform. Built’s technology has served as the ‘connective tissue’ between lenders and builders, who lacked the software to administrate transactions and track progress.

There are also significant opportunities to improve the real estate transaction cycle after acquisition. Owners and developers often acquire property with the intent to improve, whether that’s ground-up redevelopment or value-add improvements. The property improvement process, where owners and developers spent $1.9 trillion in construction costs in 2021,[1] features its own set of stakeholders who finance, design, build, inspect, and approve development projects. The property improvement process features high-volume transactions (construction loans, contractor billings, home improvement loans) that often require frequent compliance checks and payment periods. Managing or occupying real estate creates more touch points in the payment cycle. Owners inject working capital into properties to secure leases, manage tenant experiences, and maintain the performance of their assets. Residential tenants and landlords, who exchanged $485 billion in rent payments in 2021[2], bring additional urgency to the real estate transaction cycle, with 61% of U.S. consumers living paycheck to paycheck and U.S. consumers spending almost 30% of their income on rent[3].

[1] US Census Bureau, Average construction spending in the US from 1993 to 2021

[2] National Association of Realtors, CBRE

[3] Lenders Club, Statista, CNBC

Real Estate Transaction Cycle

Nine Four is focused on identifying stakeholders in the property improvement and management cycle who are underserved by incumbent financial institutions. While there are a growing number of construction software solutions on the market, most of those are focused on large, enterprise builders. However, these enterprise builders employee only 2.3% of the construction workforce while 60% of construction workers are employed by companies with less than 50 employees[1]. Without the budgets to invest in large-scale enterprise solutions, SMB construction companies operate almost entirely offline. Construction payment cycles are extremely slow, with contractors often not being paid for 90-120 days, and SMBs lack the digital tools to accelerate payment cycle and stay on top of project costs.

Nine Four portfolio company Vergo is focused on developing financial tools specifically for architects, engineers, and contractors. Vergo is a neobank that distributes spending cards to SMB employees to help them easily track and allocate costs towards projects. Product features and rewards are concentrated on areas of relevance to this specific customer group, such as points back on construction material spending and higher credit limits to support on-demand construction equipment needs. Nine Four has also invested in Kojo, a construction material procurement platform. Supply chain management is a particularly large pain point for SMBs, who spend a significant amount of time and resources tracking the procurement process from start to finish. Kojo’s procurement platform simplifies the material payment process by linking together the product specifications, material logs, purchase orders, and invoices required to track construction materials, resulting in reduced errors and more efficient workstreams.

[1] Bureau of Labor Statistics

Real Estate Transaction Market Map

FinTechs have only just started testing the waters to accelerate and improve the real estate transaction cycle. Many pain points remain unsolved, and winners will emerge who will deliver on promises to make the real estate transaction cycle more seamless, efficient, and inclusive. Even though the massive real estate market remains underserved by technology, it is important that investors remember the lessons learned from FinTechs in other market segments. Startups must be able to deliver value to real estate stakeholders by solving the unique problems that affect the ecosystem. FinTechs that don’t build roadmaps that prioritize technology or who rely on inorganic growth fueled by expensive distribution will struggle to survive in today’s economic climate that is rewarding operational efficiency and profitable growth.

Real estate stakeholders are embracing change in many areas and demanding solutions to resolve key pain points. As the real estate ecosystem evolves to support more FinTechs, my takeaways for the real estate sector are the following:

- Faster Payment Cycles: FinTechs that can accelerate payment periods, both for commercial real estate transactions and for property improvement SMBs, will find it easier to attract customers and scale.

- Platforms Leveraging FinTech: Both incumbents and FinTechs with significant AUM will expand their offerings, either through acquisition, product development, or partnerships to own more of the real estate transaction cycle.

- Tech-Enabled Underwriting and Servicing: As the digital and integrated financial infrastructure expands, incumbent real estate owners and investors will better leverage data to improve their underwriting and servicing models.

- Incumbents Invest in Corporate Innovation: Incumbents find FinTech partners or build out inhouse digital solutions to better meet the needs of modern real estate stakeholders.

While the FinTech landscape adapts to changing market conditions and increased competition, there are many reasons to be excited about the convergence of real estate and FinTech, and the great potential of FinTech solutions to improve the real estate transaction cycle for the next generation.

Written by: MBA Associate Intern, Andrew Schwalm