Last week I attended the NMHC OPTECH conference in Dallas, TX. The event focused on technology across the facets of multifamily real estate, and was heavily attended by real estate owners, operators, managers, and technology companies targeting them. It was my first time attending and it was refreshing to have the number of tech-forward conversations that I did, and see a showroom that provided a great way to compare companies and products in a hands-on, rapid-fire, apples-to-apples way. I’m glad I went.

One of the common threads throughout informal conversations and panels was Yardi and RealPage. More specifically, the challenges of using Yardi and RealPage (from the real estate side), the challenges to unseat Yardi and RealPage (from both the real estate and technology side), and what other sleek alternatives conference attendees were trying out or had seen used elsewhere were like. It isn’t a new problem or question – in a world of constant innovation and easier, more intuitive access and leverage with data, why on earth are we using Yardi or RealPage? (Note: I’m not a user of either and have no opinion on which is better, but when folks learn about Nine Four and our focus on technology companies, property management systems is one of the first topics we’re prodded about. You can also replace Yardi with “CoStar” as a company that most people I talk to are looking for alternatives for, but yet continue to use and pay big money.)

Nine Four, and I suspect other investors in the space, have to turn this question over in our heads constantly. On one hand, there are probably more sophisticated, smarter platforms out there that do some of what Yardi does, but they’ve never seemed to get traction. Yardi and RealPage always seem to win.

The answer that we use to explain why is a relatively simple and straightforward one: for a company who manages a meaningful number of units – say 1,000 or more – ripping Yardi out and replacing it is nearly impossible because there are massive switching costs. In addition, what many want to replace it with is likely not as comprehensive as what Yardi provides, so you’d be left with gaps and/or the same integration problems with Yardi that you had before.

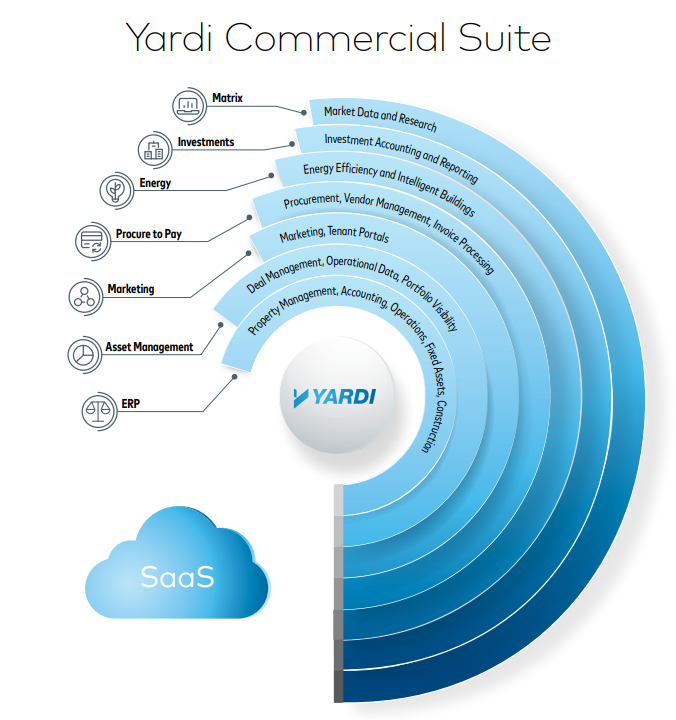

Here’s a quick snapshot of what the Yardi platform offers:

There’s a lot here!

Almost every institutional owner wants the features here, or they risk leaving money on the table. Once Yardi is installed, the workforce is trained on it, the features of these products integrate nicely with each other, and the “full-stack” integrated platform creates massive switch costs across a few spectrums:

Financial Costs: Not just licensing costs, but also hard costs and time required to train and troubleshoot on the platform. Depending on the savviness of your workforce, some may never be “as good” in Yardi as they were on something home-grown or whatever platform was in place before. Disrupting or losing customers for a large-scale owner such as a Yardi user is a tough pill to swallow and a switch really only has one short-term impact, and it isn’t a good one. Reporting changes and data availability could also delay decisions that leave money on the table (despite an alternative potentially increasing the value of those decisions over time, as many-a-sales-people at competitors contend).

Compatible Products and Customizations: Yardi and RealPage aren’t necessarily vanilla, off-the-shelf products. Many firms customize features and modules in the software to suit their specific needs. The time and money spent on these can be challenging to shift away from.

Relationships: This is likely the most nebulous, but Yardi and RealPage (and others) know the value of developing relationships with their customers. Sales teams, support teams, and company swag goes a long way in building a higher hurdle for existing customers to pull the trigger and migrate to another provider.

Yardi also does a good job of insulating itself from startups and companies trying to piggyback on its position. If a company wants to be compatible with the Yardi platform, it’s expensive (again, in terms of both time and money) to do so. APIs aren’t cheap, can run into glitches, and may be prohibitively restrictive. For example, if a company wants dynamic integration with Yardi and be able to push and pull data from the system, there could be caps on the number of times they do that a day, limits on the amount of data that’s exchanged, or potentially how data is used and owned.

So how does a company compete with a Yardi, for example?

AppFolio and a focus on the ‘low-end’ may provide a glimpse into what it may take to unseat Yardi, or at least draw a competitive response that could be beneficial for users.

AppFolio started in 2006 and focused on small and medium sized property managers. As of their latest annual report, they now have 13,046 property manager customers and ended 2018 with $190M in revenue. A simple average (not the most accurate indicator here, but likely directionally correct, and removing revenue from a legal product they sell) indicates that the average AppFolio customer spends around $1,100/mo for their platform, and manages about 300 units. On the back of these small and medium sized players, AppFolio has built a business with a $3.7B market cap (as of 11/21/19).

What’s interesting is that from a product and feature standpoint, they started small as well – first with a property management solution (2008), then marketing services (2009), payments (2010), tenant screening (2011), insurance (2012), expanded payment rails (2013), customer service and maintenance (2014), leads expansion (2015), debt collection (2016), expanded renters insurance (2017), utilities and data analytics (2018), and AI/machine learning capabilities in 2019. It paints the picture of a linear path to products and features that is growing along with their customer-base.

As it pertains to Yardi or RealPage, I’d consider AppFolio a risk from a low-end disruption standpoint. AppFolio is cheaper and has a less robust product offering tailored for a smaller customer. However, the linear path of AppFolio’s product releases indicates their ability – and willingness – to listen to their customers, create more solutions, and move upmarket. Over time, those solutions may pick off Yardi customers that are overserved or overpriced. Once those customers fall to AppFolio, competition could become fierce along the upmarket customer segments. There’s a rub here, though – typically successful low-end disruptors have a structurally advantageous cost structure that allows them to service customers at a lower cost that an incumbent can’t bear over time. I don’t know if AppFolio has that relative to a Yardi or RealPage. That said, if existing AppFolio customers continue to grow and manage more units, those customers may grow to the size of a traditional Yardi customer. In that case, the same switch costs and advantages that Yardi currently enjoys will be to the advantage of AppFolio.

Another question that this leads to for startups is how they can compete. We regularly see startups building tenant screening solutions, payment platforms – pretty much everything in the Yardi graphic above – that may be better than a single Yardi module ever could. The problem is that one of the first questions a company gets from institutional owners is “what systems do you integrate with?” that places them in an expensive and vulnerable position. Do they pay the big fees for integrations – if they’re allowed to – to play nice? How big can a business be that depends on Yardi, RealPage, Entrata, etc., that there may be competitive tension with? These are hard questions. RealPage is growing its business through strategic acquisitions, but many purchases aren’t for huge sums. Early investors in companies RealPage acquired likely did well, but viewed strictly through a RealPage lens, there may be a cap on the valuation and maturity of company that a potential VC may be able to pay if history continues to repeat itself. The math on risk-return gets significantly more challenging.

At the end of the day, we believe that there can and will be more sophisticated products that offer a property manager the tools they need. That said, we do envision a world where startups build an agile software backbone that does have a differentiated cost structure and user experience that may unseat incumbent, traditional property managers themselves (the current customers of Yardi and RealPage). This ‘vertical’ approach to property management hasn’t played out yet, but we do see some interesting companies on the horizon. Stay in touch to learn who those are and what they do!