“Survive to ‘25” was a popular slogan for startups in the bleak post-correction times. 2025, it was hoped, would be better. Now we’re here – and some things do, in fact, appear better: runaway inflation has been hindered, rates have been cut, and transaction activity across asset classes, segments, and supply chains is ticking up after skipping along the bottom. PropTech unicorn ServiceTitan had a successful IPO that many hope indicates an opening IPO window with a long queue of companies to follow (more on this later). [1] That said, there’s still plenty of uncertainty: Fed Chair Jerome Powell made comments about fewer rate cuts this year, potential trade tariffs could be on the horizon, a new administration is arriving, and a hotter-than-expected job market has created some jitters.[2]All things considered, however, we’re excited about the changing state of affairs and new technology paradigms, and continue to believe the built-world markets are ripe for adoption. Here are some of the trends and drivers we’re watching closely as we emerge into 2025 and begin making sense of the opportunities and uncertainties ahead:

[1] Reuters: Software firm ServiceTitan Valued at nearly $9B as Shares Debut, Dec. 2024

[2] Reuters: Hawkish 2025 Outlook, Dec. 2024

The Rise of Voice AI

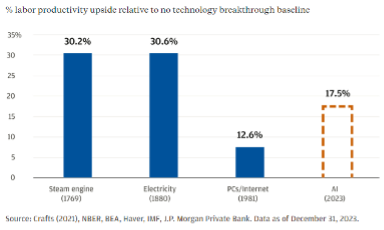

Comparable to the past breakthroughs of the internet, mobile, and cloud computing, AI is emerging as the next generational technology shift. As shown in Figure 1 below, analysts are predicting that AI has the potential to drive productivity gains and subsequent economic benefits across industries, surpassing the impact of the Internet and rivalling historic advancements like electricity.[3] Goldman Sachs predicts that two-thirds of jobs could be partially automated by AI,[4] contributing an annual boost of $2.6 to $4.4T in global GDP according to McKinsey estimates.[5] These are massive numbers.

Figure 1: Technology Productivity Breakthroughs

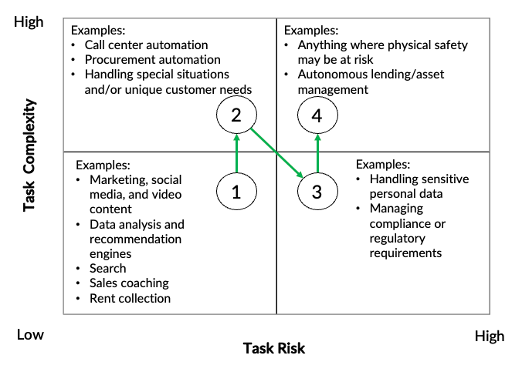

Despite AI’s potential, built-world sectors have historically lagged in tech adoption due to the challenges that arise from software integrations, user training, and data silos (among other things). However, AI is addressing these hurdles by automating tasks that once required human intervention or technical integrations. Initially focusing on repetitive, lower-risk tasks like property data analysis and marketing content generation, tech hopefuls expect AI to evolve and handle more complex responsibilities, including sensitive financial data and workers’ safety. Since AI models rely on quality data input, improving data access and structure will be critical to its effectiveness. As the adage goes – “garbage in, garbage out”: AI models are only as good as the data that trains it. As technologies progress, we anticipate a phased market adoption described in Figure 2, starting with simpler, lower-risk tasks, and progressing to higher complexity and higher-risk tasks over time until full autonomy can be achieved.

Figure 2: Early Built-World Cases for AI

As AI takes the spotlight, its rapid evolution demands attention as startups and corporates navigate its usage and strategic implications. We believe that digitization, whether driven by traditional software or advanced AI, is still in its early stages, especially as it relates to the built world. Work is transitioning from being fully human-powered to software-assisted, to then software unlocking new efficiencies, and ultimately to AI autonomously performing basic and repetitive tasks once done by humans.

It’s clear that as we enter 2025, the AI segment gaining momentum and having near-term impacts on human work is ‘Voice AI,’ where AI converses with humans in natural language and performs tasks autonomously. Early general examples include OpenAI cloning voices from ~15 seconds of audio,[6] or translating spoken language seamlessly.[7] Now, venture dollars are accelerating the development of more specialized applications across industries. For example, Nine Four portfolio company Rilla is building voice AI platforms to improve human sales rep performance at home services companies—a nuanced, human-intensive field requiring emotional intelligence, adaptability, and deep product knowledge, where hiring and retaining top talent remains a challenge. Another more specialized example of voice AI is Shilo, an AI sales coach tailored towards real estate agents that provides real-time call grading with intuitive feedback and sentiment analysis to enhance performance and productivity.

Unlike traditional software companies, Voice AI startups have a relative sales advantage in directly replacing human labor while offering clear, measurable improvements in ROI and operational efficiency. Hiring and retaining good sales coaches is challenging at best, so implementing voice AI can lower the burden of complex integrations, employee training, and staged rollouts, to accelerate sales cycles and reduce costs.

[3] Chase: How AI can boost productivity and jump start growth, Aug. 2024

[4] Goldman Sachs: Generative AI could raise global GDP by 7%, Apr. 2023

[5] McKinsey: The economic potential of generative AI: The next productivity frontier, Jun. 2023

[6] The Verge: OpenAI Voice Generation AI Model, May 2024

[7] Rest of World: OpenAI is making a risky bet on live translation, May 2024

Tariff Implications Making Waves Whether They Happen or Not

A scenario exists where proposed tariffs under President elect Trump’s aggressive policies could drive up inflation and lead to a subsequent ‘higher for longer’ rate environment.[8] To no surprise, the proposed tariffs on China, Mexico and Canada are particularly detrimental towards the procurement of imported construction materials, such as steel and wood products, both of which the U.S. imports over the amount they export. In October 2024, the top three sources for U.S. steel imports were Canada (39.7%), Brazil (25.3%), and Mexico (18.3%),[9] while the top three sources for U.S. wood imports were Canada (46.9%), China (9%), and Brazil (6.6%).[10] With Canada, Mexico and China all together accounting for over 50% of both U.S. steel and lumber imports, these tariffs could significantly drive up construction project costs and drastically impact budgets for contractors and developers. The uncertainty surrounding trade policies can further disrupt supply chains, causing delays and complicating the material procurement process from the potential pivot in suppliers that builder may need to adapt to.

However, these supply chain challenges also present opportunities for startups to offset the new operational procurement-related burdens with innovative solutions. With the increase in costs posed by these tariffs, Nine Four portfolio companies like Nickel and Kojo are digitizing the procurement to payment process, with sales tax automated compliant payments and end-to-end management of the flow of funds for material orders respectively. To prevent further procurement delays, Nine Four portfolio company Nuvo streamlines the trade credit process to reduce timely costs and error between the changing supplier and vendor relationships. And now with more at stake between U.S. buyers and LatAm suppliers, Latii’s platform for the procurement of quality LatAm material is essential to streamline quoting, increase transparency, and build trust across the industry. All these PropTech innovators and more are continuing to pave the path for a more resilient and optimized procurement ecosystem in the face of evolving global trade dynamics.

[8] CBO: Effects of Illustrative Policies That Would Increase Tariffs, Dec. 2024

[9] OEC: Iron and Steel in United States, Oct. 2024

[10] OEC: Wood Products in United States, Oct. 2024

Slivers of Opportunity in Manufacturing

Through our new Pre-seed+ program, we are working with Brian Chen to build Kite Compliance, an AI-powered platform focused on the analog world of product certifications, which is a key step in the value chain between OEMs, distributors, installers, and end-customers. Certifications ensure product quality, component standards, and production methods meet expectations and subsequent price points for buyers. They’re critical in the built world and with anything hardware related.

Products must pass formal tests at accredited labs to earn certifications. Despite its importance, many certification processes still rely on spreadsheets, legacy ERPs, or third-party consultants, resulting in opaque processes, slow turnaround times, human errors, and wasted capital. What standards need to be met for this customer? What’s the building code where the products will be installed? How often does recertification take place? What are the legal requirements? What about environmental standards? There are a lot of questions certifications answer, and a lot of hand-holding and manual workflows involved. To that end, we believe there are opportunities to streamline critical pre- and post-certification workflows using software and AI.

In the pre-certification process, OEMs often rely on hardware engineers to handle compliance, requiring them to research and reference certification requirements. Accredited labs then receive and test the physical products, which often have long wait times measured in months. We believe there’s an opportunity for software and AI to 1) shift the compliance burden away from hardware engineers and 2) streamline accurate pre-testing before lab tests. This could help boost productivity, reduce failed lab tests, and accelerate time-to-market.

In the post-certification process, we envision an opportunity to digitize and streamline annual re-certifications and replace error-prone human and spreadsheet management. With fragmented regulations and workflows across products and geographies, we believe the certification industry is well-positioned for AI agents to provide accurate answers and reduce compliance costs in the re-certification process.

ServiceTitan’s Success is a Win for PropTech

ServiceTitan’s IPO success marks an exciting milestone as we hope its performance, market, and strategy will buoy other PropTech companies with similar attributes. Initially, there was skepticism about the size of the software opportunity in home services, contractors’ willingness to pay for software, and the strength of barriers to entry. ServiceTitan has proven that vertical SaaS markets can grow to support venture-scale returns, even in historically tech-averse industries, with a vertical SaaS strategy that supports building compounding competitive advantages and durable moats.

Although ServiceTitan generates most of its revenue from its core SaaS product, its rapidly growing FinTech offerings now represent ~25% of total revenue,[11] and supports the assertion that vertical SaaS companies can create a wedge with core software and extend into customers’ funds flows — how they get paid, pay vendors, and finance operations. Payments is a scale game, and ServiceTitan is in the early innings of showing how meaningful that scale can be. Combined with the rise of PE-backed rollups in the home services industry, we believe there will be scale and consolidation that will serve as the playbook for other software companies to scale to IPOs. This renewed optimism is resonating across the industry, as evidenced by statements from the heads of Equity Capital Markets at Citi and Bank of America: with Citi noting that “several companies that were weighing first-half 2026 IPOs are now aiming for the second half of 2025 instead, after seeing ServiceTitan … shares trading at a premium to peers,” while Bank of America similarly expressed confidence that we’re “going into 2025 with the expectation that we will see a very active US IPO market — big sponsor monetizations, more consumer and tech assets and a fintech pipeline that we have not seen as developed, for several years.”[12]

We expect that in 2025 investors will reassess built-world vertical SaaS startups and industries once seen as ‘too small’ or ‘slower-moving’. It’s true that adoption and progress has been slower relative to other industries, but a greater need for technology and a growing number of faster moving startups are forcing the rest of the market to change.

[11] SEC: ServiceTitan S-1A, Dec.2024

[12] Bloomberg: Trump Tariff Risk Casts Doubt on IPO Blowout Forecast for 2025, Dec. 2024

P&C Insurance Opportunities Come Back

Weather patterns across the U.S. continue to intensify, triggering catastrophic (“CAT”) events such as hurricanes, tornadoes, and wildfires. These disasters drastically impact the lives of those unfortunate enough to endure them, while also making the insurance ecosystem those affected are forced to deal with even more expensive and complex.

Catastrophic events drive a surge in insurance claims and strain insurance companies. Operating in an increasingly punitive regulatory environment makes it difficult for insurers to operate sustainably in certain regions, often to the point of abandoning markets and leaving homeowners and policyholders without options. For example, California state regulators have made it nearly impossible for insurers to raise premiums in line with rising replacement costs driven by inflation.[13] This has led many of the largest insurance companies to exit the state entirely, putting property owners in a pinch.The recent devasting Los Angeles wildfires exemplify this crisis, destroying over 12,000 homes and structures to date,[14] which is estimated to have caused almost $150B in damages and economic losses thus far.[15]Despite the growing frequency of CAT events and the tough regulatory environment, we believe the pressure will create opportunities for startups that can underwrite and price risk appropriately, and ultimately serve as beacons for policyholders that they felt insurance companies were always meant to represent.

Digitally Native InsurTechs Could Fill the Void Left by Incumbents

Digitally native InsurTechs such as Nine Four portfolio company Steadily, are helping to push industry evolution. Remarkably, we’re hearing that 65+ year-old property owners who were dropped by incumbents are now buying insurance from startups. Although players like Steadily are new and might not have the trove of data that incumbents have from doing business for decades (or close to a century), they benefit by starting from the ground up and not suffering from tech, ops, and/or people debt. Steadily started with a clean slate and streamlined everything from acquiring policyholders through claims management. In the world of AI, a business with a unified structure that can create and structure data should be able to move faster and leverage its data in ways that incumbents cannot. A watch-out, in this case, is an adverse selection — underwriting higher-risk policies that incumbents made a conscious decision to leave behind would be problematic. Things could work out as long as upstarts maintain discipline, keep a healthy balance between growth and efficiency, charge fair risk-adjusted premiums, and do not overextend themselves on the risk curve.

As investors start giving credit to publicly-traded MGAs such as Kinsale and digitally-native InsurTechs such as Lemonade, Root, and Hippo for improving loss ratios and profitability, we’re building stronger conviction that it’s possible to build durable and venture scale businesses with efficient models in this segment.

New Structured Data Could Augment the Underwriting Approaches of Upstarts and Incumbents

Startups are bringing new tools to market that could enable carriers to remain active in states like California by helping them more accurately underwrite in higher-risk geographies. Many insurance companies struggle to differentiate risk from homes in the same zip code. Companies like Cape Analytics are helping insurers collect more precise data to better underwrite these risks on a property-to-property basis. These tools can help carriers identify attractive assets in overlooked or nuanced areas, particularly homes that may have been recently renovated to updated building codes and could provide more accurate risk assessment and policy offerings. Startups like Resiquant provide this by plugging into municipality databases and “filling in the blanks” for missing structural building data at scale with sleek AI backbones. We expect to see more disparate datasets be applied to underwriting in the future, with AI leading the charge in 2025.

[13] AFPI: California’s Homeowner Insurance Market Freefall: Regulatory Folly Run Amok, Jul. 2024

[14] AP News: Families in shock begin to visit their charred homes in the Los Angeles area, Jan. 2025

[15] Investopedia: Insurance Company Stocks Fall as Damage Estimates from California Wildfires Rise, Jan. 2025

Fading ESG Initiatives

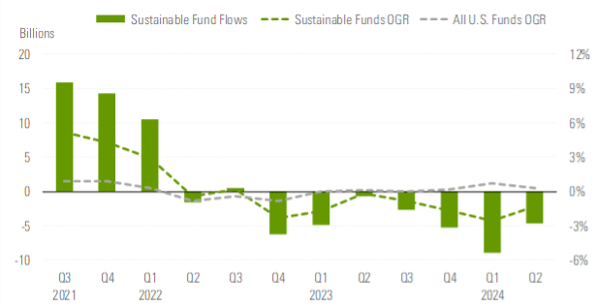

An unfortunate byproduct of the shifting macroenvironment dynamics is that the focus on ESG investments and initiatives are continuing to fade. As shown in Figure 3 below, investors are renewing an emphasis on financial returns and viewing alternative investment options as more appealing than sustainability focused funds. According to the 2024 ‘ESG Tracker’ report by the Association of Investment Companies, there’s been a continued decline from 66% of investors in 2021 to just 48% in 2024 showing consideration of ESG factors towards investments and only 17% of surveyed investors believing ESG investing is likely to improve returns vs the 22% from the prior year.[16]

Figure 3: US Fund Flows: Sustainable Vs. All US Funds (USD Billion)[17]

Additionally, regulatory headwinds and skepticism about the effectiveness of ESG frameworks have further slowed momentum in this space. Asset managers across Europe and the U.S. have wound down hundreds of ESG funds as the Financial Conduct Authority’s anti-greenwashing regulations come into effect.[18] Amidst investor criticism, the SEC has also disbanded its Climate and ESG Task Force and removed ESG as a 2024 priority for its Division of Examinations,[19] reflecting the growing public narrative of waning focus on sustainability-focused funds. This shift emphasizes the broader investor pivot toward prioritizing tangible financial returns over aspirational yet often ambiguous ESG metrics.

Nevertheless, this growing uncertainty surrounding ESG investments, combined with the rapid advancements in AI, opens opportunities for innovative solutions, particularly within the PropTech and real estate space. Despite the decline in general investor focus, ESG continues to be a priority amongst PropTech and real estate investors as the spotlight shines on the growing energy demands across properties and how the rise of AI can potentially balance investments’ sustainability with long-term financial viability. PropTech AI solutions are poised to play a transformative role in the sustainable real estate development process, as aggregating and analyzing energy data now becomes even more pivotal for optimizing energy usage and decarbonization efforts. Beyond the tangible operational cost efficiencies that AI can enable through centralizing and monitoring this data, these solutions can also lead to clearer transparency in data-driven reporting, addressing the previously mentioned shaky investor confidence in ESG credibility, which is especially critical in these high-rate environments of economic uncertainty.

[16] AIC: ESG Attitudes Tracker: passion for ESG investing cools further, Oct. 2024

[17] Morningstar: ESG Funds Bleed Less Money in Q2 2024, Aug. 2024

[18] Bloomberg: Hundreds of ESG Funds Are Being Wound Down, Morningstar Says, Oct. 2024

[19] ESG Dive: SEC disbands its climate and ESG enforcement task force, Sep. 2024

Thank You and Please Reach Out!

A big thank you to our founders and partners! We’re fortunate to work with you as many of the insights we’ve gained and the work we’re most proud of comes directly from collaboration. As we head into 2025, we’re filled with gratitude and look forward to working tirelessly with you.

If you’re an industry stakeholder adopting new technologies or a founder launching a new venture, we’d love to hear your thoughts and connect!

Disclaimer: This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by Nine Four Ventures. All views expressed herein are the opinions of Nine Four Ventures employees and are not the views of our affiliates or investors.