In December, Nine Four Ventures General Partner Kurt Ramirez tagged along on an organized trip by Nine Four portfolio company Latii for US dealers/buyers of high-end windows and doors to meet Mexican fabricators. The goal was for the dealers and fabricators to learn more about each other, understand needs and opportunities, and ultimately build trust that could culminate in each party opening to new markets.

Introduction to Latii:

To start, it’s important to understand what Latii is trying to build in order to fit together how incentives are aligned and how relationships are formed between them, US buyers, and LatAm fabricators:

Right now, if you want to build a higher-end or custom home, you’re probably going to work with an architect and/or designer. Their jobs are to design the home to the point of handing a blueprint to a builder, who then brings the plans to life. In the designs and drawings, an architect may specify what materials, brands, or products to use, but odds are those specifications are few and far between since it’s a nearly impossible task to have comprehensive knowledge of all material costs, product awareness, and building practices for each plan (that said, manufacturers still do their best to build relationships with 1) architects, so that their products are specified in the plans, and 2) builders, so they can familiarize themselves with a specific manufacturer’s products and installation). Once a builder receives the plans, many decisions are now up to them, and they propose what they believe will thread the needle between customer satisfaction and margin for the work. Subcontractors also often have discretion: the kitchen cabinet materials may be recommended or purchased by the subs, with the owners ultimately specifying the finishes.

Specific to Latii, this dynamic exists with windows and doors in more than just homes. Plans may specify the size and design of a window, but the ultimate decision of where the window is purchased, the brand, frame, glass materials, hinge, handle placements, and/or screen placement and compatibility often falls on the builder, who, with appropriate authorizations and approvals, usually purchases from someone they have an existing relationship with. In this case, it’s usually a local dealer who then communicates with brands and manufacturers to provide quotes and time frames for purchase, delivery, and installation. Dealers and their sales teams own relationships with manufacturers and serve as conduits for new products and materials that different manufacturers are introducing to their markets. Dealers are also often tasked with installation and customer service should a customer need it. Builders tend to have two or three dealers they trust when procuring materials, with some builders working exclusively with a single dealer. This is why local relationships play a critical role in the purchasing process.

So where does Latii come into play?

You can think of Latii as another brand that a dealer has to quote a window or door. But where most brands represent a single manufacturer, Latii represents a variety of fabricators and manufacturers in LatAm that are producing higher quality products that are cheaper and closer to the US. Currently, many building products are imported from abroad – particularly China – and carry tax and regulatory risk, language barriers, and subject purchasers to a fragile global supply chain. So, a ‘near-shored’ offering such as Latii could reduce risk while producing higher quality products at lower prices and with shorter lead times.

To build a successful company in this space, it’s critical that Latii and their manufacturing/fabrication partners meet and exceed all standards and expectations that their US purchasers are used to, such as the building quality, window design, technical drawings, and training for installers. Currently, many steps of the purchase process are analog and slow. Customers call dealers, dealers call manufacturers, the manufacturers figure out what their current capabilities and turnaround times are, fabricators then go through their iterations, and ultimately an initial quote is generated. That quote is presented to a dealer, who then presents it to their buyers, and the initial revisions and negotiations ensue until a decision is made and an order is placed. This process can take weeks and is where Latii is focusing their software and technology development. The fragmentation between buyers and sellers creates an opportunity for the marketplace software Latii is developing to rapidly scale and capture value. A platform that can digitally provide the quality and trust necessary in this relationship-heavy business has potential to unlock new levels of productivity.

Transitioning back to the trip, the goals for tagging along were to:

- Meet US dealers and learn more about their current processes and partners

- Understand how US dealers view Latii and Latii’s fabrication partners, and what they need to get over the hurdle and engage with Latii in meaningful ways

- Meet Mexican fabricators to understand how they operate, their ceiling on quality and throughput potential, and the nuances of accessing the US market

The Trip, and Learnings:

The first stop of the trip was to a showroom in Mexico City to see a variety of installed products in a high-end custom home (the entire home was a showroom, which was fun to see).

Entrance to the home showroom

The most insightful part of the showroom tour was listening to the questions the US dealers/installers asked, and gauging their general reactions to each product as it was checked out. It was immediately apparent how technical windows are: the installers had pocket flashlights to check out corner finishes, screw locations, locking and hinge mechanisms, they wanted to understand what parts could be customized vs not, they tracked and measured water drainage, and compared everything to existing products they were selling and installing. Things like U-Factors and energy efficiency were discussed, as well as the differences in thermal breaks, metal types (primarily aluminum vs steel), and common problems they see in the field. When manufacturers and fabricators engage local architects, conversations tend to center around branding and aesthetics, but not the nuances of the installation process. The US dealers/installers cared more about the latter and could also appreciate the complexity behind the technical detailing. The Mexican fabricators ate this up and were enthused to learn about a new customer, their local markets, and expectations.

The next stops were to the fabricators themselves.

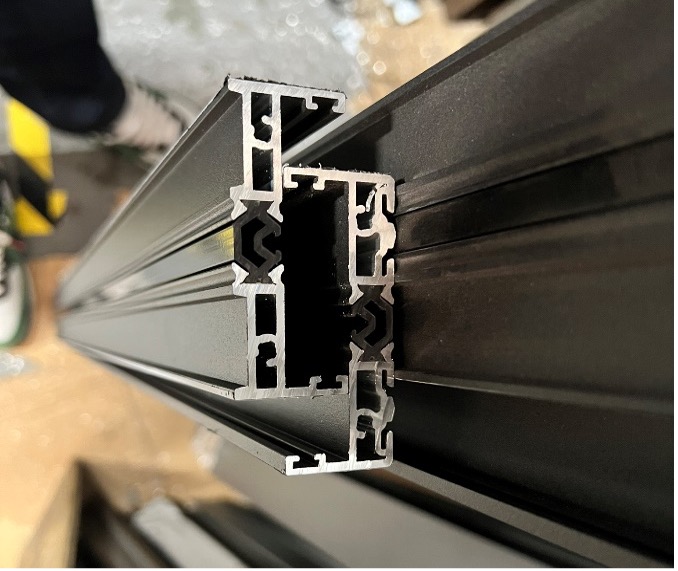

Cross-sections of aluminum window frames being assembled

Kurt has spent a fair amount of time in oil refineries and their machine shops, so he was quick to notice that these fabricators were nowhere near as large, which led to the first quick learning and validation of a Latii value prop around the market of LatAm fabricators itself: the vast majority of LatAm fabricators and manufacturers are small, yet many produce high quality outputs and are interested in breaking into the US market. There isn’t a “standard” of larger facilities implying higher quality, so it’s less about the size of the plant and much more about the skill of the labor, machinery, and outputs. Santi and the Latii founders observed this while at Tul, their prior company, and this continues to be validated as more manufacturers and fabricators proactively engage with Latii. This is ultimately a core tenet for Latii: they can and will vet LatAm manufacturers and fabricators to ensure a high Latii standard is met. This trust is imperative for their marketplace to work.

The US dealers’ observation around size and scale highlighted the dilemma that LatAm manufacturers/fabricators and US buyers are in:

US dealer/installer networks that dominate the market are too small and fragmented to devote resources to finding, vetting, and developing relationships in LatAm, and the LatAm fabricators are too small and fragmented to do the same in the US.

This was corroborated throughout the trip across numerous conversations with the US dealers/installers and fabricators. Latii’s goal is to solve this dilemma and enable 1) US buyers to access high-quality, lower-cost LatAm fabrication/manufacturing, and 2) LatAm fabricators/manufacturers to finally tap into the US market. Latii also has the ability to aggregate larger orders across several manufacturers, when necessary, which removes a scale hurdle that the dealers highlighted.

The next questions naturally segued into how Latii can solve these dilemmas and build their marketplace, particularly from a cold start. What was apparent from both sides of the marketplace is that the biggest factor in bridging the gap and getting business and products flowing is trust and scale. US dealers work with high-end customers with high expectations. Dealers’ reputations are on the line if things go south, so they are unlikely to take risks unless they are very comfortable that things will go according to plan. The dealers must be able to access people and information about orders and products on-demand to provide assurances for themselves and their customers. The LatAm fabricators understand this. They won’t get many opportunities, so they must ensure that their quality, timing, and expectations are met or exceeded. By doing so, they can be rewarded with the volume they’ve been looking for to grow. Trips like these for US dealers to visit manufacturers, see the facilities themselves, and put a face to a name of the products they might be selling are an important step in getting these relationships moving.

Discussing Latii with dealers and fabricators exposed other value-creating and strategically relevant components that Latii leans in to (it’s also worth emphasizing that Latii isn’t in a position where they can let any single component in the sale-to-installation process down, because that would represent a break in the process/product and very likely diminish the experiences and value for each side of the marketplace). For example, aside from the previously mentioned strategic implications of matching highly fragmented dealers with highly fragmented fabricators, Latii assists fabricators in streamlining, digitizing, and standardizing quotes. Latii does this by pairing traditional market education with pricing databases and eventually real-time fabrication/manufacturing schedules. The goal for Latii’s marketplace is to eventually not involve the LatAm fabricators/manufacturers in the quoting process, where Latii simply turns over orders that fabricators know fit the schedules, prices, and margins that make sense. This would take everything off the plates of fabricators/suppliers and allow them to focus on their core businesses. Latii does the rest, and could command a premium take-rate, and potentially SaaS revenue + products further down the track, as a result.

It was a short and busy trip that drove home Latii’s opportunity to create a marketplace that solves a lot of problems and creates a lot of value, placing emphasis on several classic Bill Gurley digital marketplace characteristics. Dealers and fabricators walked away having learned a lot about each other and with next steps to work together. Nine Four Ventures is excited to see how Latii’s story and marketplace evolves!

Disclaimer:

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by Nine Four Ventures. All views expressed herein are the opinions of Nine Four Ventures employees and are not the views of our affiliates or investors.