The Vertical SaaS Opportunity in Home Services

The Value of Vertical

Over the last decade, the potential of vertical SaaS, software targeted at a specific market, has been thoroughly validated. Early on, software companies looked to create common solutions applicable to as large of a potential userbase as possible – giving rise to horizontal SaaS giants such as Salesforce, HubSpot, and Workday. However, a bevy of vertical SaaS unicorns such as ServiceTitan, Procore, Toast, and Nine Four’s portfolio company Built Technologies have proven the value proposition of verticalized software.

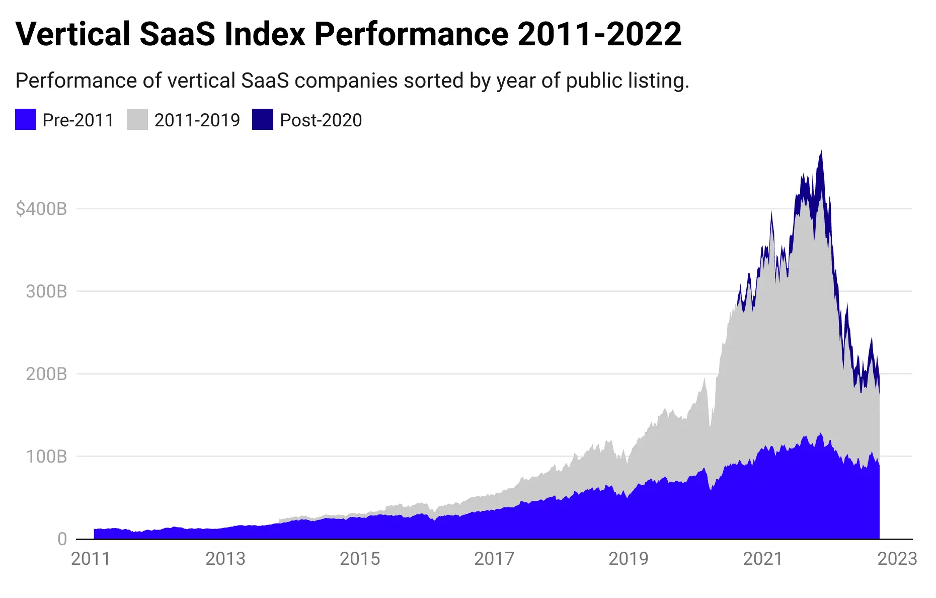

We believe the vertical SaaS approach isn’t going anywhere – the total market cap of Fractal’s Vertical SaaS Index, which tracks IPO-based cohorts of key public vertical SaaS players, has grown tremendously over the last decade and show resilience in the face of downturn, remaining above its pre-pandemic highs

Source: Tidemark

By narrowing the aperture, vertical SaaS companies can be much more targeted in their approach, developing purpose-built features and integrations focused on distinct industry use cases that solve specific pain points, lower the bar for adoption, and make it more difficult for challengers to copy. Similarly, they can be more targeted in their go-to-market strategies to drive down customer acquisition costs (CAC). This lower CAC and more nuanced set of product features result in lower cost structures, and potentially lower prices compared to horizontal solutions, attracting industry customers that both can’t afford more comprehensive solutions and find them often lacking in the specific functionality they need most. As such, the core strategy is to trade market size for market share – by dedicating themselves to addressing the issues of a specific customer, leaders in many vertical and SMB markets can reach market shares considerably higher than horizontal software market leaders[1].

Home (Services) Is Where The Heart Is

Today, software usage has become ubiquitous across industries, making vertical software more relevant and valuable than ever. While the home services industry has always been an attractive prospect for vertical SaaS with its unique product requirements, it has been known for its resistance to change and slow adoption of new technologies. However, changes in macro-economic dynamics, demographics, and industry makeup have shifted the industry and created an exciting opportunity for vertical SaaS expansion.

Macro Landscape

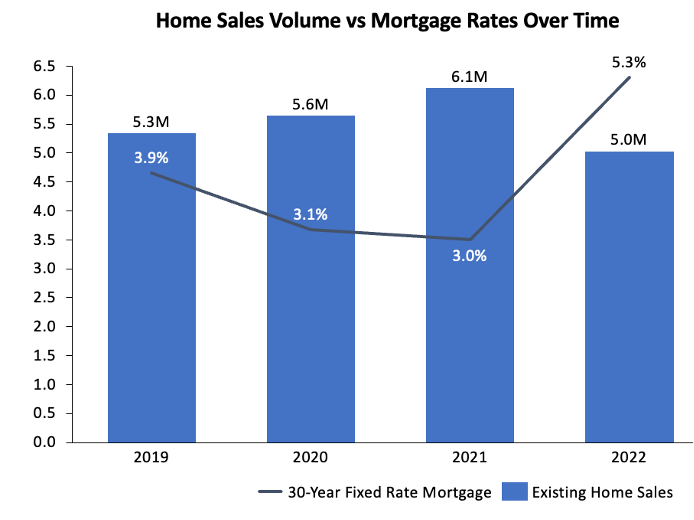

As interest and mortgage rates have increased in parallel from their pandemic record lows, it has become more expensive to buy a new home, anchoring people into their existing homes and leading many to instead focus on fixing up and improving their current property.

Source: National Association of Realtors, Federal Reserve

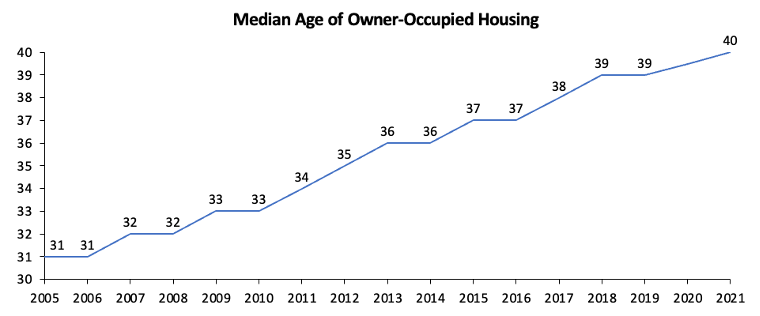

The median age of US housing stock is reaching a high of 40 years old. Baby Boomers are growing older and need help with bigger maintenance tasks like preparing their homes for aging-in-place, while younger generations want to upgrade their older, out-of-date homes but often lack the technical skills (30% of Millennials don’t own a ladder[4]) required for repairs and DIY projects.

Source: American Community Survey

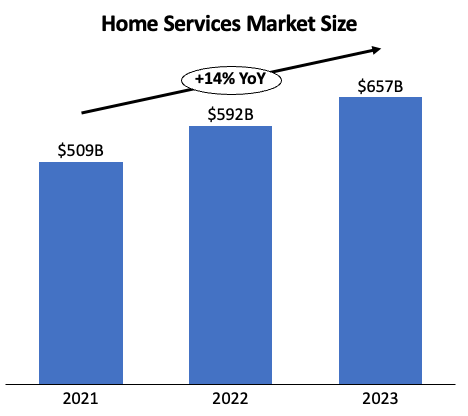

This decrease in new home purchases and increased need for skilled pros, combined with the highest homeownership rates in a decade and a half (homeowners spend more than twice as much as renters on home services), and record home equity levels (which is often borrowed against to finance home improvements) have led to strong macro tailwinds for the home services industry, resulting in ~14% YoY growth[6].

Taken as a whole, these macro factors imply a larger, growing market filled with high-intent, active customers for vertical SaaS companies eager to find ways to differentiate and take advantage of increased demand.

Source: Angi

Demographic Shift

There is a changing of the guard happening as Millennials, who are more interested in piloting and potentially using technology compared to prior generations, are taking over as owners and operators from Boomers and Gen X. According to a survey by Deloitte, 75% of Millennials believe that digital tools and technology are essential for businesses to thrive, significantly higher than the 49% of Generation X with the same opinion[7]. This sentiment can be seen in companies like Hoffmann Brothers, a home services family business that was recently passed from father to son. After taking over, the son (Chris Hoffmann) brought Hoffmann Brothers into the NexStar network, reworked processes, and implemented technological solutions like ServiceTitan. In doing so, he was able to help grow the company from $10M in revenue to $100M+ in less than a decade[8].

Furthermore, on the end-customer side, Millennials are now the plurality of homebuyers, responsible for 43% of purchases and growing[9]. Unlike their parents’ generation, Millennials are more inclined to expect instant, on-demand services. This can be seen in their higher adoption rates of on-demand services like ride-sharing, where 18- to 29-year-olds use such services twice as much as 50- to 64-year-olds[10]. This shift in homebuyer demographics, and thereby home services customer demographics, could have profound implications for the industry, as it needs to adapt to meet the changing preferences of this tech-savvy and service-oriented generation.

These trends create an attractive environment for vertical SaaS companies because they have an increasingly tech-adept customer base to sell into, whose own customers increasingly expect convenience and technology-based solutioning.

Industry Consolidation

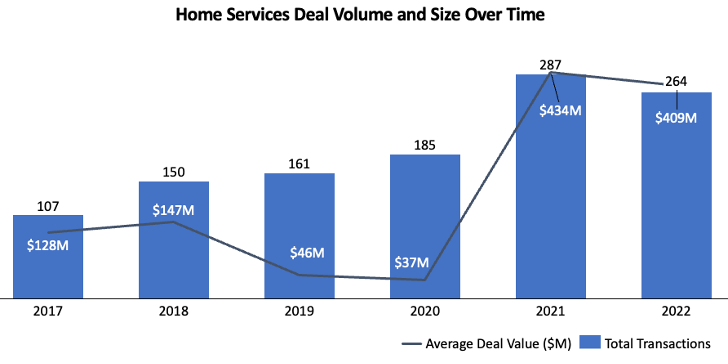

Home services typically operate in highly fragmented markets. According to IBISWorld, major players comprise only 5.6% of U.S. electricians[11]. Similarly, within HVAC, Service Logic (one of the largest privately-owned companies in the sector) has estimated revenues of $200 million which is a drop in the bucket compared to the ~$40B North American HVAC market size[12][13]. However, over the last six years, the home services sector has experienced a growing wave of acquisitions and consolidation[14].

Source: Greenwich Capital Group

Private equity firms have seized the opportunity to attempt to roll up this fragmented market and attempt to create winners with economies of scale. They’ve pursued two different models, purchasing and merging franchisors across a range of industries due to their lower capital expenditure and easily scalable model, or consolidating mom-and-pop shops across the same industry that they’re able to acquire at low multiples. A number of the largest players in the home services are now PE-created or PE-purchased entities: Authority Brands was bought by Apax Partners in 2018[15], in 2020 The Riverside Company began acquiring and merging trade services franchisors to create Threshold Brands[16], and in 2021 KKR purchased Neighborly[17]. In fact, the aforementioned Service Logic was bought by Warburg Pincus in 2017 (before being sold again to Leonard Green & Partners in 2020)[18].

Key Home Services Consolidations

| Company | Owner | Trades | Brands | Franchise Units / Locations |

| Neighborly | KKR | HVAC, Housekeeping, Landscaping and Lawn, Plumbing, Painting, Glass, Home Inspection, Pest Control, Handyman, Electrician, Restoration, Doors | 29 | 5000+ |

| Threshold Brands | The Riverside Company | Flooring, Housekeeping, HVAC, Pest Control, Plumbing, Insulation, Restoration | 10 | 500+ |

| Authority Brands | Apax Partners | Pool, Plumbing, Housekeeping, Painting, Restoration, Waste Removal, Electrician, Landscaping, Pest Control, HVAC, Screens | 15 | 2000+ |

| Empower Brands | MidOcean Partners | Outdoor living, Roofing, Irrigation, Restoration, Housekeeping, Insulation, Lighting, Windows, Fencing | 10 | 900+ |

| Service Champions | Odyssey Investment Partners | HVAC, Plumbing | 16 | – |

| Strikepoint Group | New Mountain | HVAC, Plumbing, Electrical, Insulation | 32 | 43 |

| TurnPoint Services | OMERS | HVAC, Plumbing, Electrical | 53 | 57 |

| American Residential Services | GI Partners | HVAC, Plumbing, Electrical, Insulation | 38 | 76 |

Importantly for vertical SaaS companies, this consolidation means that there could be a bigger universe of larger customers to target, that are often efficiency-driven and more open to software solutions, while still leaving much of the long-tail SMB customer base that could typically be more interested in vertical solutions.

How To Stand Out

So, making targeted software is a successfully proven model and home services present a particularly attractive opportunity to utilize the approach, how can companies that pursue that direction stand out in the space?

1. Provide a unique value prop that a horizontal solution can’t

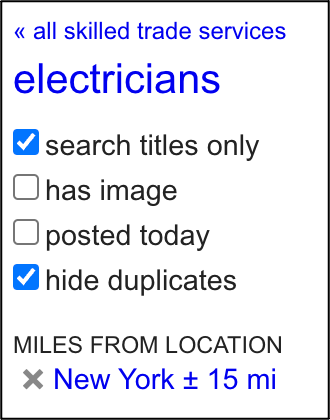

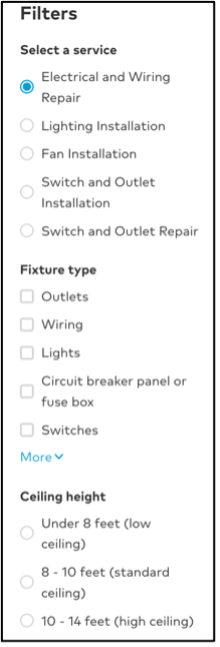

Fundamentally it doesn’t make sense for a horizontal solution targeting as wide a market as possible to build unique feature sets and integrations for every sub-vertical it might cover. Doing so could be expensive, time-consuming, and potentially result in a bad user experience while taking an unfocused product development strategy. Consider the case of Thumbtack (a home services-specific marketplace) versus Craigslist (a broad horizontal marketplace). While Craigslist includes everything from finding housing, to merchandise, to jobs, to services, Thumbtack is squarely focused on searching for and booking home services. As a result, Craigslist’s sorting and filtering options under “Services” are stock standard, while Thumbtack has been able to create custom filtering for each service type. Furthermore, once users select pros on Thumbtack, they’re brought through a trade-specific questionnaire to nail down the details of the job. These purpose-built features lead to both more relevant results for users who are more able to find professionals that fit their needs and higher quality leads that are more likely to convert for service providers – creating a virtuous flywheel of repeat users and referrals that reduce CAC and increase lifetime value (LTV). For Craigslist to build out a similar level of depth would require a level of knowledge, engineering resources, and capital that the company might not have, and could ultimately lead to disparate experiences across the platform, creating confusion for users.

Built wide or built deep – the left shows Craigslist’s filters when searching for electricians, while the right shows only a portion of Thumbtack’s narrowing criteria

Source: Craigslist, Thumbtack

In addition to purpose-built features, vertical integrations are critical. Continuing the example, Thumbtack integrates directly with existing software platforms relevant to home services providers such as Housecall Pro (a popular home services CRM tool). This specific integration allows Thumbtack leads to seamlessly flow directly into Housecall Pro user inboxes, while also pulling scheduling from Housecall Pro to share availability in Thumbtack. These types of integrations that push and pull data automatically are imperative because they decrease potential adoption friction (like requiring new customers to input data manually) thereby making it easier for customers to get the most value out of it quickly – but just like vertically focused features, these integrations often don’t make sense for a horizontal platform to pursue.

Identifying where your startup can provide unique value above and beyond what a horizontal solution can provide is key for establishing its competitive edge.

2. Have a unique distribution channel

Differentiated access to customers is key when operating in such an SMB-heavy and community-driven space. When your customers are smaller, they tend to have a smaller annual contract value (ACV) meaning that acquiring customers through pounding the pavement and one-on-one interactions is not as scalable as other segments. There’s often a “build it and they will come” perception amongst startups, however, home service providers are bombarded with new CRM and estimating software alternatives, and like most professions, their core competency is doing their job not sorting through software options; relying on the quality of the product alone is often not enough[19].

A recent twist in this equation is the previously mentioned PE-driven consolidation within the home services industry. This development means that there is now a larger benefit to creating an enterprise-focused sales motion. Targeting these enterprise customers requires longer sales cycles, but successful conversion potentially implies larger ACVs, lower churn, bigger upsell opportunities, and strong signaling that your product is useful and trustworthy to other potential customers. As a result, deep connections within the private equity space have become another avenue to differentiated distribution.

Whether through exclusive access to industry groups, proprietary relationships with adjacent entities like insurance companies for work orders, or aligning financial incentives with strategic investors successful home service vertical SaaS companies need an edge in how they acquire customers, and those with the relationships and connections to quickly and efficiently reach a wide swath of tradesmen and women are at a distinct advantage.

3. Utilize proprietary data

Having access to data that others don’t have creates a moat between you and your competition. For example, Nine Four portfolio company Inspectify serves as a marketplace and system of record for home inspections. The inspection data recorded in the platform is otherwise rarely tracked or recorded in detail, and as such provides a level of previously unavailable insights allowing the software to call out issues like scratched floors, chipped paint, and broken water heaters, etc. that wouldn’t normally be identified and creating an opportunity to suggest preventative remediation plans to address problems before they become bigger projects.

Having proprietary data, whether it be through partnerships, novel collection methods, unique levels of customer access or exposure, or otherwise limits the risk of direct competition and can provide avenues to increase willingness to pay from customers.

4. Land and expand strategy

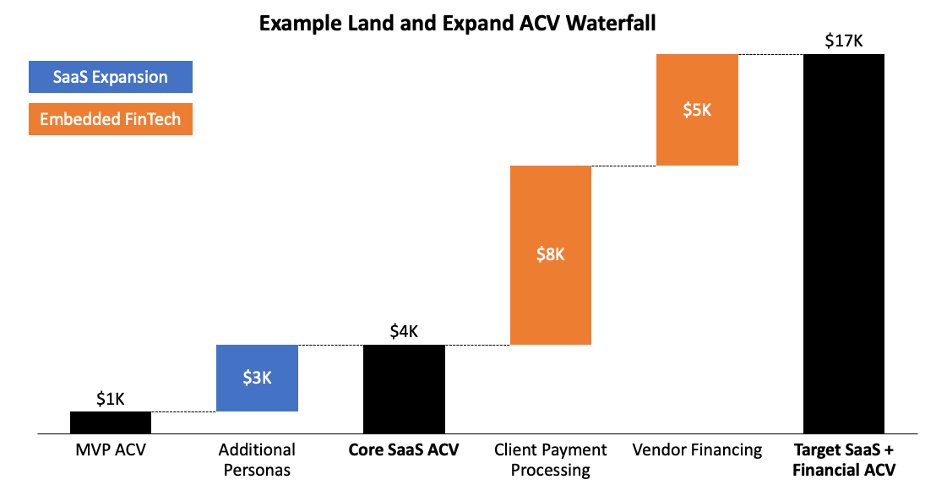

Venture capital funds look to identify companies that have the potential for hypergrowth. This necessitates companies that aren’t just features or point solutions but have the potential to land and expand, developing into comprehensive platforms used across their customers’ business.

ServiceTitan exemplifies the benefits of this approach. The company started by addressing a critical pain point in the home service industry—managing the complex operations of field service businesses. They provided tools for scheduling, dispatch, job tracking, and technician management. By offering a strong wedge product, they were able to attract a large customer base, and then expand across other parts of their business by adding back-office tools like inventory management and job costing that were relevant to additional customer personas. As they became more deeply ingrained into their customers’ operations, ServiceTitan was able to offer embedded FinTech solutions such as payments and financing – greatly extending its value proposition and ACV all without raising CAC[20].

Source: Nine Four

By focusing on industry-specific pain points and keeping an eye on purposeful expansion across their customers’ tech stacks, vertical SaaS companies can create a more holistic value proposition that resonates both with their target audience, which may ultimately lead to sustained and efficient growth.

Build, Baby, Build

The home services space is rapidly evolving and presents an exciting opportunity for verticalized software to thrive. By creating purpose-built products, utilizing unique distribution channels, leveraging proprietary data, and developing an expansion-focused strategy entrepreneurs can set themselves apart from their competition and position themselves for success in the space.

As investors, Nine Four Ventures is excited to bring its domain expertise and strategic corporate partners to support the next winner in home services vertical SaaS. If you’re building, please get in touch!

By: David Russell (MBA Associate Intern) with help from the Nine Four Team.

DISCLOSURE INFORMATION

This document does not constitute advice or a recommendation or offer to sell or a solicitation to deal in any security or financial product. It is provided for information purposes only and on the understanding that the recipient has sufficient knowledge and experience to be able to understand and make their own evaluation of the proposals and services described herein, any risk associated therewith and any related legal, tax, accounting, or other material considerations.

[1] https://www.tidemarkcap.com/vskp-chapter/vertical-saas-truisms

[2] https://www.statista.com/statistics/226144/us-existing-home-sales/

[3] https://fred.stlouisfed.org/series/MORTGAGE30US

[4] https://www.nar.realtor/magazine/real-estate-news/millennials-short-on-skills-tools-for-home-maintenance

[5] https://eyeonhousing.org/2023/02/the-aging-housing-stock-6

[6] https://www.angi.com/research/wp-content/uploads/sites/2/2022/07/Angi-Economy-of-Everything-Home-2022.pdf

[7] https://www.deloitte.com/global/en/issues/work/content/genzmillennialsurvey.html

[8] https://podcasts.apple.com/jp/podcast/chris-hoffmann-building-scale-in-home-services-ep-167/id1445929750?i=1000609459584&l=en-US

[9] https://www.nar.realtor/newsroom/nar-report-shows-share-of-millennial-home-buyers-continues-to-rise

[10] https://www.statista.com/statistics/827870/ride-hailing-services-adoption-by-age-group-us/

[11] https://www.ibisworld.com/united-states/market-research-reports/electricians-industry/

[12] https://www.linkedin.com/pulse/5-factors-driving-consolidation-hvac-industry-brian-cohen/

[13] https://www.ibisworld.com/industry-statistics/number-of-businesses/heating-air-conditioning-contractors-united-states/

[14] https://greenwichgp.com/wp-content/uploads/2023/01/MA-Trends-in-Home-and-Commercial-Services-1.pdf

[15] https://www.apax.com/news-views/funds-advised-by-apax-partners-acquire-authority-brands/

[16] https://www.riversidecompany.com/currents/riverside-sweeps-in-with-latest-trade-services-franchise-strategy/

[17] https://www.businesswire.com/news/home/20210708005304/en/KKR-to-Acquire-Leading-Home-Services-Platform-Neighborly%C2%AE

[18] https://warburgpincus.com/2020/11/02/service-logic-announces-acquisition-by-leonard-green-partners-from-warburg-pincus/

[19] https://www.reddit.com/r/Roofing/comments/10pkpqe/why_are_roofing_apps_so_bad/

[20] https://a16z.com/2020/08/04/fintech-scales-vertical-saas-2/