In our current COVID world, PropTech is in the spotlight. It’s a time when we’re 1) having more conversations than ever about how we interact with our environment and 2) seeing more adoption of digital solutions across all facets of the real estate lifecycle than ever before. That said, we also argue that even with the digital advances we’re seeing, we’re still in the early days of PropTech company potential. Real estate incumbents are still largely relying on old companies and agent/broker led industries, with many startups remaining on the fringes of being taken seriously and/or changing the industries that interact with real estate in meaningful ways. It may not be that way for long, though: PropTech companies have a major opportunity to shortcut the path to massive value creation for themselves and their investors. That path is through FinTech.

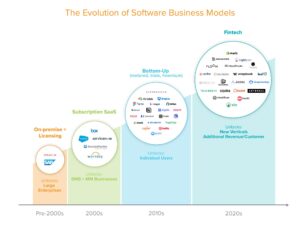

The market dictates what business models it’s ready for. A16z articulates the evolution of business models for software companies in the following graphic:

The authors continue on:

Today, about 90% of public SaaS companies and the 2019 Forbes Cloud 100 have subscription-based revenue models. Now new fintech infrastructure companies have made it possible for SaaS businesses to add financial services alongside their core software product. By adding fintech, SaaS businesses can increase revenue per customer by 2-5x* and open up new SaaS markets that previously may not have been accessible due to a smaller software market or inefficient customer acquisition.

Perhaps the most important highlight is the fact that infrastructure startups are making it increasingly easier to add financial services to their core products in a frictionless way that benefits everyone. In the multifamily industry alone, more than $500B of rent payments are processed a year, and multifamily originations rose to more than $600B in 2019. These are massive capital flows to and from landlords, which are then passed on through the operation and maintenance of the assets they own, and supported by tenants. These landlords, operators, and managers, therefore, represent major growth potential for the software companies that could layer financial products into their offerings. Yardi, for example, is in a prime position of owning the accounting stack and many of the operational components for many large multifamily owners. Layering more traditional financial products through a technology stack like that could unlock meaningful value. The construction industry is also rife with inefficiencies in payments and lending products. Built Technologies is a company that’s well positioned to take advantage of the same opportunity. Home services is another $100B+ size market with terrible NPS scores, poor payment flows, and even more complexities to find parts and labor. It’s a messy industry with massive fragmentation and inherently hyper-local, but it’s a valuable industry and one that many have been challenged to improve.

If the broader real estate ecosystem reacts in a similar way as other industries, the size and scale of the markets PropTech companies touch can launch startups into massive growth and profitability much faster than what we’ve seen before. The public markets clearly value these characteristics, at least for the moment, as they continue on a tear in what my colleague Paul refers to as the ‘Great Acceleration’. Once the genie is out of the bottle and SaaS solutions are adopted, the likelihood of replacing software with labor appears to be dissipating as margins for customers increase and user experiences continue to improve. These companies getting into the flow of payments, processing, and lending products for industries worth trillions of dollars is an incredibly lucrative proposition as digital adoption increases. This is a path that we expect many PropTech companies of today to pursue, and one that we support.

Sources: