SaaS has become a preeminent software business model: it provides predictable, high margin revenue and efficient, scalable growth. SaaS also enables startups to grow beyond software tools and into marketplaces by aggregating the supply side density needed to jump start online marketplace liquidity. The combination of SaaS and marketplace network effects creates complex activity systems expediting growth, strengthening competitive advantages and expanding addressable markets over time. In this blog post we will discuss how OpenTable successfully transitioned from pure-play SaaS to a SaaS enabled marketplace and what it means for PropTech companies trying to do the same.

In 1998, OpenTable started by selling a reservation software tool (i.e. initial product vertical) to restaurants (i.e. offline, fragmented industry vertical). OpenTable didn’t know it at the time, but by starting with a software tool, this strategy inadvertently aggregated the supply side density needed to jumpstart its future online marketplace. Today, demand goes to OpenTable’s online marketplace to search, discover, connect with and book the best restaurants in their local areas. Selling B2B software in the beginning is what allowed OpenTable to evolve into the incredible SaaS enabled marketplace it is today and $2.6 billion acquisition target for Priceline Group in 2014.

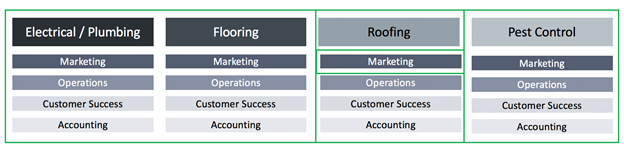

What can we learn from OpenTable? When starting a SaaS company, it’s typically easier to begin with an initial product vertical (i.e. reservation software) in an offline fragmented industry (i.e. restaurants) rather than online concentrated ones. For example, in the home maintenance and repair market, it may be better to focus on one industry vertical such as plumbing, roofing, pest control or electrical, because it’s easier to solve a precise pain point well and develop a loyal customer base. It’s also easier to focus on offline fragmented markets rather than online concentrated ones because offline markets tend to have less technology competition (i.e. pen, paper, excel spreadsheets) and fragmented markets tend to be made up of smaller customers which are generally cheaper and faster to acquire and easier to service with self-serve products.

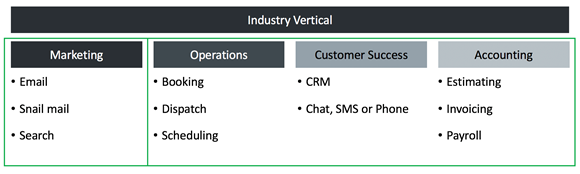

After selecting an industry vertical, it can be advantageous to drill down further and focus on one specific product vertical, such as, marketing, customer success, accounting, etc making it easier to provide the absolute best solution for a precise problem. Sales plays a critical role in the success of every business, so a natural initial product vertical to start with could be marketing (website builder, CRM, attribution, etc.), to help technicians acquire new customers more efficiently by increasing existing market penetration rates and extending into new markets (although other entry points can work too). As technicians acquire more customers, they need to buy more software to service those new customers. It is at this point when it is timely to expand the initial product vertical focus into other tangential product verticals within the industry vertical including operations, customer success, accounting, etc. As a startup expands its initial product vertical horizontally, the platform becomes a single source of truth and its value only grows with each subsequent data point added. Subsequently, this increases a customers’ willingness to pay, makes the software more and more difficult to “rip out” and creates incredibly sticky revenue. There are likely outliers that could prove this approach to be false but, in most circumstances, this framework should hold true.

Note, this is not an exhaustive list of products and product verticals but simply an illustrative example.

The transition from an initial product vertical tool (i.e. roofing marketing) into an industry vertical platform (roofing marketing, operations, customers success, accounting, etc.) is extraordinarily powerful because it creates the supply density (i.e. roofers) needed to build a marketplace on top. Marketplaces are notoriously challenging to start because of the chicken-and-egg problem. Without supply or demand, it’s difficult to attract the other. So, SaaS helps solve the chicken-and-egg problem by aggregating supply side density of the marketplace and jumpstarting marketplace liquidity. Chris Dixon, General Partner at Andreessen Horowitz famously wrote his “come for the tool, stay for the network” blog post five years ago and reinforces the importance of using software to build supply density and liquidity in online marketplaces[1].

These SaaS-enabled marketplaces can make for and support incredibly dynamic, large businesses. The activity systems created between a SaaS platform and marketplace are underpinned by network effects. For example, as initial supply is aggregated, demand is attracted to the marketplace to transact with the supply. As more demand transacts through the marketplace, it drives more supply to the marketplace. The new supply that was previously not on the marketplace needs business management software to help service all of the new demand. As a result, more demand feeds supply growth and supply growth feeds demand growth. Said differently, marketplace growth feeds SaaS growth and SaaS growth feeds marketplace growth. As more and more marketplace transactions occur, it provides marketplaces with the data to better understand who to target when, where and how. It is this flywheel effect that drives exponential growth, lowers customer acquisition costs and makes these SaaS enabled marketplaces so incredibly difficult to disrupt.

In conclusion, the idea is to start small and go big. Start as an initial product vertical tool and grow into an industry vertical platform over time. SaaS aggregates the supply side density needed to jump start marketplace liquidity. Lots of startups can be successful given myriad product verticals (electrical, flooring, roofing, pest control, etc.), target markets (SMB, mid-market, enterprise) and asset types (single family, multi-family, commercial office). The prevalence of so many large, fragmented, offline industry verticals in PropTech make it well positioned to produce many future SaaS enabled marketplaces.

If you’re a Founder building a

vertical SaaS startup, it would be a privilege to connect and discuss how your

business can evolve into a SaaS enabled marketplace. Through our partnerships

with Ace Hardware, State Farm, national home service brands and real estate

owner operators, we can assist in expediting the transition.

[1] httpss://cdixon.org/2015/01/31/come-for-the-tool-stay-for-the-network